Call us now:

Establishing Your Corporate Bank Account in Thailand

Establishing your corporate bank account in Thailand involves several pivotal steps to prepare for commencing operations. In this guide, we explore the intricate yet essential process of opening a corporate account with a Thai financial institution, empowering new businesses with valuable knowledge. For official guidelines, refer to the Board of Investment of Thailand’s page on opening bank accounts

Table of Contents

What are the key considerations in Thailand ?

Before initiating the account opening process for your corporate bank account, it’s essential to familiarize yourself with the specific requirements and regulations in Thailand :

- Legal Structure Ensure that your company is legally registered and in compliance with all regulatory requirements in Thailand.

- Type of Account Determine whether you need a Thai baht or foreign currency account based on your business needs and anticipated transactions.

- Documentation Prepare all necessary documents, including your company’s registration certificate, articles of association, shareholder information, and identification documents for authorized signatories.

- Minimum Deposit Be aware of the minimum deposit requirement set by the bank, which may vary depending on the type of account and banking institution. This criteria will depend on the branch and the Bank.

- Company documents It is imperative to have the full set of the company documents. Please see below the list of documents required to open your corporate bank account.

- Personal Identification Documents Ensure you have identification documents for the company’s directors, shareholders, and authorized signatories, such as passports, Thai ID cards, or work permits for foreigners, to complete the process of opening a company bank account.

What are the required documents ?

To open a corporate bank account, you will need to provide the following documents. Please note that requirements may vary depending on the bank:

- Company Affidavit (dated within the last 3 months)

- Bor Jor 2, 3, 5 (company registration documents)

- Minutes of Meeting signed by the shareholders

- Thai shareholder and director ID cards (signed)

- Passport copies of directors and shareholders

Additional documents and information may be requested if you wish to apply for online access, such as email and phone number. Please note that the phone number must be Thai.

What factors should you consider when choosing the right bank ?

Selecting the right bank is a crucial decision that warrants careful consideration. Factors to think about include the bank’s reputation, range of services offered, accessibility, fees and charges, online banking capabilities, and customer support. Our lawyers at Benoit & Partners can assist you with the process of opening a corporate bank account in Thailand and choosing the right bank. For personalized assistance and to learn more about the specific requirements of your chosen bank, consult with our experts today.

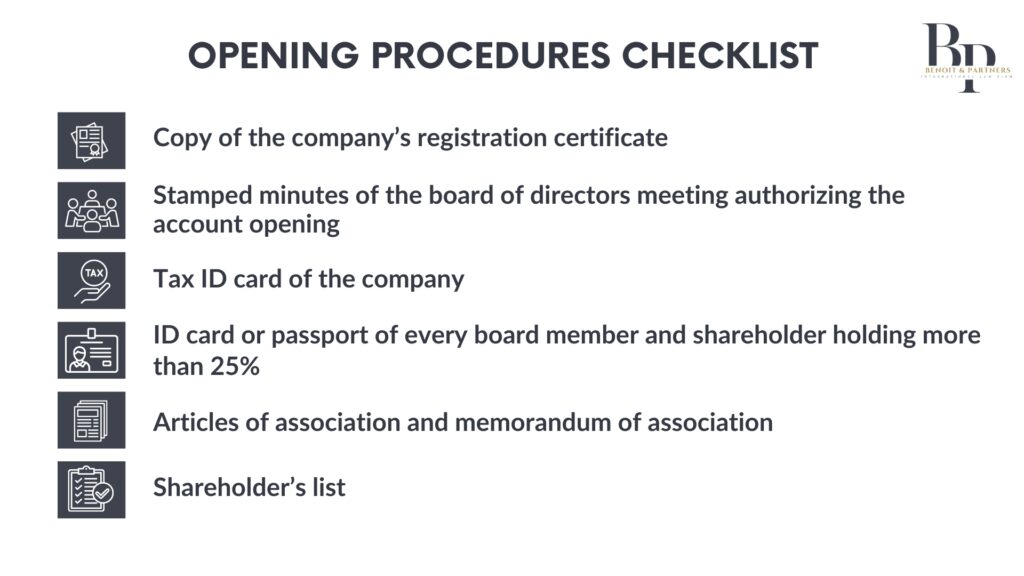

What are the opening procedures and requirements ?

Opening a corporate bank account in Thailand involves specific procedures and document submissions. Typically, you’ll need :

Further documentation, including but not limited to work permits, company records, tax details, and personal financial information, may also be necessary, contingent upon the particular policies of the bank.

How do you navigate the account opening process for the corporate bank account ?

Once you’ve selected a suitable bank and gathered the requisite documents, you can proceed with the account opening process. Here’s a step-by-step overview:

- Schedule an Appointment Contact your chosen bank to schedule an appointment or visit their local branch in person.

- Meeting with Bank Representatives : Upon visit, you will meet bank representatives such as bank branch manager and account officer who will assist you with the account opening process and answer all questions you may have.

- Document Submission Submit all documents needed for the bank compliance team to verify and review.

- Application Review and Approval the bank will carefully examine your application and attached documents to retaliate for compliance with the law and the bank’s internal rules. Approval may take a few business days as the bank may run background checks.

- Account Activation after approval, the bank account is activated and account details such as account number and online banking credentials are provided.

How to open your online corporate banking ?

Once your corporate account is approved, the bank will provide you with access to their online banking platform.

- You will receive login credentials and instructions on how to access your account online.

- Set up any additional security measures provided by the bank, such as two-factor authentication or token-based authentication, to ensure the security of your online transactions.

Familiarize yourself with the online banking platform and the range of services offered. These may include fund transfers, bill payments, payroll processing, foreign exchange, and various types of account management tools

Can you open a corporate bank account in foreign currency ?

Yes, it’s possible to open a corporate bank account in foreign currency in Thailand. Many banks in Thailand offer multi-currency accounts that allow businesses to hold funds in various foreign currencies which include:

- Thai Baht (THB)

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Japanese Yen (JPY)

- Chinese Yuan (CNY)

- Australian Dollar (AUD)

- Singapore Dollar (SGD.

- Hong Kong Dollar (HKD)

It’s advisable to consult with your chosen bank to understand the specific requirements and any limitations associated with foreign currency accounts.

Get expert legal guidance.

Do you need a work permit ?

Some banks may need a work permit, but it is possible to open a foreigner’s corporate bank account at the Thai bank. However, there are additional requirements and differences between the banks and primary accounts. For this reason, it is recommended to contact the desired bank to clarify its conditions with foreign corporate bank account’s opening.

Is it possible for non-residents to open a corporate bank account in Thailand ?

Non-residents can open corporate bank accounts in Thailand, but it requires some extra steps. They need a registered legal entity in Thailand and must provide identification documents. It’s important to comply with Thai tax laws and regulations, so checking with the chosen bank for specific policies is crucial.