Call us now:

Accueil / Company Registration in Thailand / BOI Company in Thailand: Benefits and Legal Process

BOI company in Thailand: Legal requirements and investment conditions

Setting up a BOI company in Thailand offers numerous advantages, including the potential for full foreign ownership, tax exemptions, and other fiscal incentives. However, navigating the complexities of the BOI application process requires more than just a basic understanding of the rules. To successfully secure BOI privileges, businesses must meet stringent requirements, including preparing a comprehensive business plan, addressing tax implications, and understanding the legal framework established by the Investment Promotion Act of 1977 and related regulations.

At Benoit & Partners, we guide foreign investors through the BOI process. From assisting with the BOI application to ensuring your business complies with all local regulations. Our firm’s knowledge of Thai corporate law, tax benefits, and BOI’s complex approval procedures ensures that your business is set up properly.

Engaging an experienced lawyer is essential to avoid delays, optimize tax benefits, and ensure your business takes full advantage of the BOI incentives. Benoit & Partners is here to guide you, providing expert legal advice so you can focus on growing your business in Thailand.

Get expert legal guidance.

Table of Contents

Understanding the BOI Company in Thailand

The Board of Investment, under the Prime Minister’s Office, is tasked with promoting both domestic and foreign investment in Thailand. To accomplish this goal, the BOI has established an extensive catalog of eligible business activities and offers a variety of fiscal and non-fiscal incentives to qualifying companies. Perhaps most crucially, the Investment Promotion Act of 1977 safeguards foreign investors’ assets in the country.

BOI plays a pivotal role in Thailand’s economic development, maintaining offices worldwide to attract capital. A BOI company may receive tax breaks lasting up to thirteen years. This provides welcomed relief as the company works to align its operations with BOI’s complex guidelines. Yet adhering to regulations proves worthwhile, given incentives like waived corporate taxes.

Several BOI programs exist to suit different needs. Activity-based incentives correspond to a master list of eligible industries and may combine tax benefits and non-tax benefits. Performance-based incentives offer extra tax relief for research and technology training initiatives or investments in underdeveloped areas and industrial parks. Special Economic Zones go a step further, providing extra exemptions for certain sectors in addition zones.

Most recently, BOI has committed to spurring growth in Thailand’s southern provinces through new and existing venture support. By promoting all corners of the nation, the organization strives to strengthen Thailand’s competitive edge on a global stage.

How to Apply for a BOI Company License ?

There are several essential steps required for a successful BOI company application.

Step 1: Initial Steps with BOI Company

One essential step that should not be overlooked is the feasibility study. Investors wishing to apply for an investment grant can obtain preliminary information and get an application form through two channels:

- Investment Bank headquarters, regional offices, or overseas offices.

- the official wbesite of the BOI: www.boi.go.th

Step 2 – Application for Investment Assistance

Applicants for investment support for eligible activities can only apply online through the e-Investment Promotion Service at www.boi.go.th. to learn more

However, this rule has exceptions, such as the following:

- Applications for assistance to increase productivity.

- Applications to promote the relocation of companies.

- Applications to encourage business investment at the grassroots level.

Step 3 – Define the project of your BOI Company

You must make an appointment with a Board of Investment official to clarify the project of your future BOI company within ten business days of submitting your application.

Step 4 – BOI Company Project Review Process

The Board of Investment officer will review the projects based on the investment capital review period.

- Investment capital up to 200 million Baht will be reviewed within 40 days of submission.

- Investment capital up to 2 billion Baht will be reviewed within 60 days after the submission of the complete documents.

- Investment capital exceeding 2 billion Baht will be processed within 90 days after the submission of the complete documents.

Step 5 – Notification of processing results

The Board of Investment rapidly reviewed applications, regularly informing prospects of their fate within a week. Whether accepted or denied, the letter outlined any benefits from the investment promotion scheme. It also reminded recipients that a separate form secured funding certification.

Those approved had a month to fully furnish details to the Board, though extensions could be requested if more time proved necessary. Up to three delays might be granted by writing to explain the continued incomplete application. Therefore, the applicant aimed to submit promptly to avoid last-minute difficulties.

Step 6 – Approval of the decision to incentivize the BOI company

The investor must accept the incentive offered to their BOI company in one of two ways within one month of receiving the written decision.

- Complete the form through the Electronic Investment Promotion Service website at www.boi.go.th.

- Submit a promotion acceptance form (F GA CT 07).

Step 7 – Apply for a promotion certificate for your BOI company

In addition, Investors who has set up a BOI company should apply for a promotion certificate and supporting documents through two channels within six months.

- Fill out the form through the e-Investment Promotion Service at www.boi.go.th.

- Complete the “Application for Promotion Certificate” (F GA CT 08) and submit the documents required to issue the promotion certificate.

Step 8 – Issuance of Promotion Certificate

The BOI will issue the Promotion Certificate for the new BOI company within ten business days of receipt of the completed application and supporting documentation.

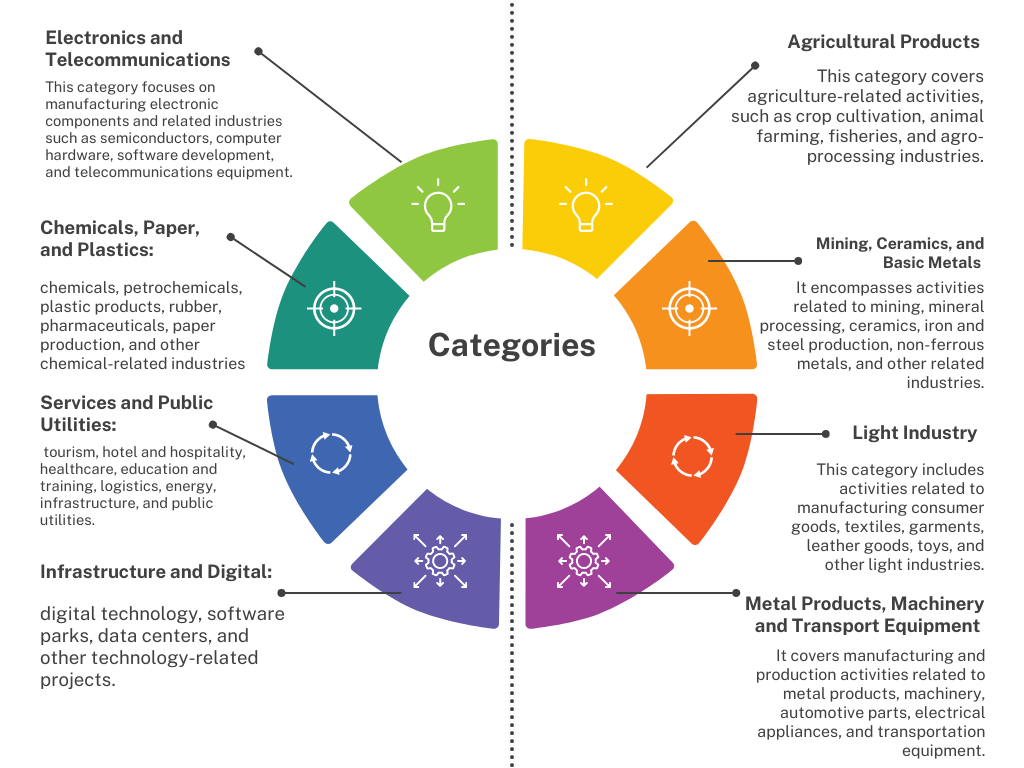

Exploring Different BOI Company Categories

The Thailand Board of Investment (BOI) offers various investment promotion categories to attract and support different types of businesses. There are ten BOI categories to consider:

BOI Company benefits and conditions

Conditions for the Agricultural products category

- Projects must have a propagation process.

- Projects must use modern technology, e.g., closed house system, evaporative cooling system, automatic watering and feeding system, vector control measure and system, a sensor system for tracking and counting animals, and adequate environmental protection and impact reduction system.

- Projects must have a traceability system.

Incentivesfrom this category for the BOI company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Mining, Ceramics and Basic Metals category

- Mining licenses (Prathanabat) or mining sublease licenses must be obtained before submission of the investment promotion application.

- Not eligible for merit-based incentives.

Incentives from this category for the BOI conpany

- A 3-year corporate income tax exemption for the BOI company

- Import duties exemption on machinery

- Exemption of import duties exemption on raw materials used in production for export

- Non-tax incentives:

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom

Conditions for the Light Industry category

Projects whose investments or expenditures on research, design, or product development of not lower than 0.5% of the first three-year combined project’s total revenue.

- Projects with no investment or expenditures on research, design, or product development or if the investment on research, design, or product development is less than 0.5% of the total revenue of the first three years combined.

Incentives from this category for the BOI Company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Metal Products, Machinery and Transport Equipment category

- Continuous forming process from pressing, pulling, casting, or forging non-ferrous metal within the same project.

- Forming process, i.e., machining and stamping.

- The project must have a forming process of main engine parts, e.g., cylinder head, crankcase, crankshaft, camshaft, connecting rod, piston, and flywheel.

- Assembling of multipurpose engines or equipment.

- Projects must have an assembling process as approved by the Board.

Incentives from this category for the BOI Company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives:

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom

Conditions for the Electronics and Telecommunications category

- Products must meet Thailand’s Energy Efficiency Standards and have the High Energy Efficiency Label (Label No. 5) from the Ministry of Energy or other equivalent standards from acknowledged institutions.

- The compressors must be for air conditioners, freezers, and refrigerators that meet the Energy Efficiency Standards and have the High Energy Efficiency Label (Label No. 5) from the Ministry of Energy or other equivalent standards from acknowledged institutions.

- Product design must be included in the manufacturing process for the production of motors.

- Not eligible for merit-based incentives.

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Services and Public utilities category

- if the project uses coal, it must only use clean coal technology.

- Must be approved by relevant government agencies.

- The paid-up registered capital must not be lower than 10 million Baht.

- Must supervise associated enterprises in foreign countries or their foreign branches in at least one country

- Must have a business plan and scope of business

- IHQ projects are not eligible for merit-based privileges

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery is only for R&D and training activities.

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Infrastructures and Digital category

• Projects emphasizing research and development in digital technology, innovation, and infrastructure development may receive additional support and incentives.

• Projects involving the development or utilization of intellectual property rights may receive support regarding IP protection and enforcement.

• Projects must comply with relevant laws, regulations, and standards in Thailand, particularly those related to infrastructure development, digital technology, and data privacy.

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives: 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws), Permit to own land, Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Eco-friendly category

- Projects that promote energy efficiency, energy-saving technologies, and energy management systems may be eligible for BOI promotion.Environmental impact assessment and adherence to environmentally sustainable practices may be required, depending on the nature of the project.

- Projects emphasizing research and development in renewable energy, energy conservation, and clean technologies may receive additional support and incentives.

- Projects that involve developing or utilizing intellectual property rights related to eco-friendly and alternative energy technologies may receive support in terms of IP protection and enforcement.

- Projects must comply with relevant laws, regulations, and standards in Thailand, particularly those related to environmental protection, energy generation, and waste management.

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption for the BOI company

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the High-Technology Industries category

- Projects contributing to technological advancements, innovation, and knowledge creation may receive additional support and incentives.

- Projects involving developing, commercializing, and protecting intellectual property rights in high-tech fields may be eligible for benefits and assistance related to IP protection and enforcement.

- Projects must comply with relevant laws, regulations, and standards in Thailand, particularly those related to high-tech industries, research ethics, and intellectual property rights.

- Environmental impact assessment and adherence to environmentally sustainable practices may be required, depending on the nature of the project.

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

Conditions for the Chemical Papers and plastics category

- Chemical products, which are consumer products such as paints, cleaning products, automobile lubricants, compound chemical fertilizers, insecticides or herbicides, cement-based adhesives, etc., are not eligible for promotion.

- It must have a plastic-forming process.

- Must have plastic forming process using domestic plastic raw materials only.

- Must have a hygienic production process and be certified with relevant standards such as GMP or Food Grade within two years of the operation start-up date.

- The production process must contain a product coating process using biodegradable plastic.

- Must have an engineering design process such as particular load-bearing capacity or shockproof capacity, etc.

Incentives from this category for the BOI company

- A 3-year corporate income tax exemption

- Exemption of import duties on machinery and import duties exemption on raw materials used in production for export

- Non-tax incentives

- 100% foreign ownership (except activities under List One annexed to the Foreign Business Act B.E 2542 (1999) or stated in the laws)

- Permit to own land

- Permission to hire skilled workers and experts to work in the Kingdom.

What are the advantages of a BOI company ?

The Board of Investment’s tax and non-tax benefits aim to attract foreign capital to Thailand.

Tax Incentives offered to BOI company

Fiscal incentives offered to BOI company strategically encourage activities through total foreign ownership, duty exceptions or cuts for equipment, lowered import taxes on materials and commodities, and research and development import duty exemptions. Profits and dividends from promoted activities are exempt from corporate income tax, as are gains and distributions from advanced technologies and innovations. Options involving a 50% corporate tax reduction, double deductions for utilities, and a 25% construction and installation cost deduction also exist. Import duty waivers apply to raw and basic inputs for exported manufactured goods.

Non-tax incentives offered to BOI company

Non-tax perks offered to BOI company given by the BOI include allowing foreigners entry to explore opportunities, permitting skilled experts in supported sectors to work, and ownership rights to property. Money may also be freely sent overseas in foreign currency. Furthermore non-fiscal benefits administratively smooth visa and work permit processes for foreign firms, remove land possession restrictions, and impose no constraints on remitting foreign exchange. Those relocating certain businesses to economic zones now take advantage of up to 13 years free from profit levies and a subsequent additional 50% exemption for five more years.

The incentives for BOI company located in Special Economic Zone

The remaining industries designated by the Board of Investment are eligible for tax incentives should they situate within special economic zones: additional corporate income tax exemption spanning 3 to 13 years up to 13 years, an additional 50% rebate enduring five years, double deduction of transportation, power, and water costs persisting ten years, deduction of 25% of equipment’s installation or construction cost above the usual deduction at assessment, exemption of import duty on machinery, discharge from import duty on raw materials utilized in manufacturing goods for export, and non-fiscal incentives like permission to own land and engage specialists. Furthermore, some economic activities in southern provinces border Malaysia may benefit from tax incentives and permission to bring in unskilled foreign labor into Thailand.

The summary of BOI company Benefits for real estate development companies includes 100% foreign ownership approval, exemption from corporate tax up to 18 years, and exemption from import tax on machinery and equipment necessary for the development project alongside fast processing and quick renewal of visas and work permits allowing experts and professionals to settle with their families ranging from 1 to 4 years contingent on the activity.

- Land ownership: Outsiders can possess tracts pending sure conditions.

- Investment: Contributed funds of up to one million Baht or beyond rely on the commercial endeavor.

- Registration time: Ninety days after giving a finished application and all demanded papers.

Key Functions of the Board of Investment

Key responsibilities of the BOI

The Board of Investment has the following responsibilities:

- To promote investments that contribute to the Thai market competitiveness by encouraging research and development, innovation, industry, and services, small and medium enterprises, fair competition, and reduction of social and economic inequalities.

- Promote activities that protect the environment, conserve energy, or use alternative energy sources to benefit Thailand’s development.

- Promote economic activities that create investments in specific areas of Thailand to balance the development of the Thai regions.

- Promote investment in southern Thailand to develop the local economy.

- Promote foreign investment in Thailand to strengthen the competitiveness of Thai businesses and Thailand’s role in the global economy.

The five investment promotion division for setting up a BOI company

A BOI Company in Thailand can align itself with one of the five Investment Promotion Divisions, depending on its industry focus, to take advantage of the specific incentives and support provided by the Board of Investment in its respective sector.

The Board of Investment has five divisions responsible for promoting investment in Thailand:

- Investment Promotion Division 1: Medical and Bio-Industries.

- Investment Promotion Division 2: Advanced Manufacturing Industry.

- Investment Promotion Division 3: Basic and Auxiliary Industries.

- Investment Promotion Division 4: Advanced Services.

- Investment Promotion Division 5: Creative and Digital Industries.

Get expert legal guidance.

How to obtain a BOI license in order to set up a BOI company ?

To obtain a BOI license for setting up a BOI company in Thailand, several key steps ought to be pursued:

Ensure that your company can be promoted by the BOI ?

First and foremost, ascertain whether your company qualifies for BOI funding. Before filling out paperwork and submitting a BOI application, one should confirm if your company is eligible for BOI endorsement. Covered under the Investment Law are over eight industries and myriad business activities. However, those absent from the BOI listing cannot procure this approval and its accompanying advantages. Thus, we advocate verifying qualification prior to applying. There are a handful of avenues for doing so:

One path is applying for a BOI from abroad. The Thailand Board of Investment has established numerous offices worldwide to facilitate investors leveraging a BOI.

A second option involves retaining an expert to aid your application. Working with a specialist to assess BOI eligibility for your business is imperative to validating your chances of obtaining one.

Develop a comprehensive business plan for your BOI company

Next, Your business plan must be exhaustive and accurate for BOI application. The reviewing BOI official will scrutinize all facets of your investment and operations in Thailand. This portion is pivotal, as an inadequately prepared business plan risks rejection. The plan needs to consider every aspect of Thai structure, management, ownership, processes, financing, human resources, investment, technology, and profitability.

Fill out the requisite BOI forms

Lastly, you will have to fill out the requisite BOI forms.

With a completed business plan in hand, you must finish all BOI documents. You must select the proper forms. Form PA PP 01-07 applies to all investment banking classifications excluding services and numbers. Form PA PP 03-08 pertains to the Services category.

While opportunities through e-commerce have grown exponentially in recent years, navigating application processes can prove perplexing without proper guidance. Referring to the various documents and requirements is certainly advised, though consistency and compliance are most crucial.

Submit your application for a BOI company on the BOI website

Creating an online account serves as the primary portal, with both Thai and English options available. Though establishing login credentials presents little difficulty, some may require supplemental assistance through alternative resources.

Once logged in, a comprehensive profile must be built. Detailing the nature of operations, investments planned, and personnel involved helps paint a full picture. But varying investment amounts and employee numbers year over year is natural, and reporting changes transparently fosters understanding. Additional requests for clarification serve to verify accuracy and eligibility, not to impose undue burdens.

The Board of Investment officer readily agreed to meet to discuss our plans for establishing a new manufacturing facility. At the meeting, a wide range of topics were covered as she sought to understand all aspects of the proposed project and business. Some elements were reviewed in greater depth to ensure thorough consideration.

All told, navigating the application and review stages proved a collaborative process. Careful preparation equipped us well to engage constructively with the officials tasked with facilitating strategic investment. With their endorsement, we are eager to commence this undertaking and pursue the opportunities ahead.

An BOI company ought to conform with all conditions set by the Board of Investment, like guidelines for secondhand machines, to harmonize with Thailand’s industrial and environmental destinations. Specific rules regarding a company’s work must be appropriately and effectively established to ensure quality is retained and environmental impact is decreased.

The Board of Investment shall particularly focus on distinguishing project-linked pollution and management issues which risk the environment. Projects or activities needing an Environmental Impact Report must comply with Thai ecological laws and Cabinet resolutions.

What records does the BOI request ?

When putting in a BOI company application, certain files must reach the officer for consideration:

- Company documents like a statement of formation, shareholder list, financial statements, and articles of incorporation (if registered).

- Passport or Thai ID of the owner (if unconfirmed).

- Financing and investment plans

- Objectives of the company; the type and scale of the company

- Nature and size of the business.

- The process, machines, tools, equipment, computers, and software on the list (note origin, amount, and worth).

- Environmental plans.

- Personal particulars (such as position, number of staff, nationality).

- Key clientele and partnerships.

- A marketing strategy.

- A business plan with service details, location, and expected earnings.

- Predicted financial and program costs for the first three years; program income (if applicable).

- Program income (if applicable).

- Company and sector brochures.

You can find all files your company requires on the BOI website.

What are the advantages of the Board of Investment?

The BOI supports overseas investment in Thailand through tax reliefs and exemptions. All benefits conferred by the Board of Investment to a BOI company are highlighted below :

- Non-fiscal incentives are offered to BOI company, such as allowing foreigners to explore opportunities by entering Thailand under Section 24.

- Skilled experts can work in promoted sectors according to Sections 25 and 26, and restrictions on land ownership are waived under Section 27.

- Profits may be freely remitted abroad in foreign currency as permitted by Section 37.

- Activity-based tax holidays aim to spur business activities through the general list.

- Entities can be wholly foreign-owned and import machinery with full or reduced tariffs. Raw materials and commodities see lowered import duties too.

- Research and development receives a duty exemption on imported materials.

- Dividends, profits from promoted activities and advanced technologies are exempt from corporate income tax.

- The corporate income tax faces a 50% reduction or could be waived.

- Transport, electricity, and water costs get a double deduction while construction and equipment installation costs have a 25% deduction.

- Export manufacturing enjoys tariff-free imports of raw materials and basic inputs.

- Non-fiscal incentives also include facilitated visas and work permits.

- Land ownership barriers are removed for foreign firms.

- No restrictions govern remitting foreign currency either.

- Fiscal Incentives for New Industries

- Realty Development Perks for Foreign Companies

- 100% overseas ownership is approved. Corporate taxes are excused for up to 18 years. Import tariffs on required machinery and equipment for the development undertaking are waived.

- Visas and work permits vary from expedited processing to timely renewals, enabling experts and their loved ones to settle seamlessly. Visas range from one to four years contingent on roles.

- Land ownership allows conditional foreign ownership. Some invest upfront capital reaching one million Baht or exceeding pending projects.

What is the minimum investment amount for each BOI project ?

Each BOI company whether a branch office or a representative office has to invest at least one million baht, excluding land procurement and operational expenditures,. The lowest baseline capital necessitated sufficient funding to cover an annual salary, included in activities qualifying for incentives.

Certain undertakings proved integral to national priorities, thus the development committee must evaluate qualification. Proposals exceeding seven-hundred and fifty million baht warranted a comprehensive examination submitted to executive leadership. This threshold did not account for real estate acquisition or working funds.

An organization seeking to establish operations in Thailand using BOI support must satisfy financial prerequisites, ensuring alignment with guidelines set forth by the governing body, such as projects eclipsing seven-hundred and fifty million baht aside from land assets and operating capital.

What is Eastern Economic Corridor and how it can benefit for your BOI company ?

The Eastern Economic Corridor has long been promoted as Thailand’s premier industrial zone, encompassing the provinces of Chachoengsao, Chonburi, and Rayong. Centered on major industries such as automotive manufacturing, electronics, and petrochemical processing, the region boasts well-established infrastructure including deep-water ports, international airports, an extensive rail network, and modern highways. The overarching aim is to catapult Thailand into the cutting-edge digital economy defined by Kingdom 4.0 initiatives. BOi company located within the EEC qualify for expanded incentives as the nation strives to realize this ambitious vision.

Thailand 4.0 intends to raise living standards across the country by forging synergistic connections between upstream technologies and downstream applications in agriculture, manufacturing, and services. Early efforts involve food and agriculture, tourism, automotive, electrical and electronic components, petrochemical production, and complementary fields such as robotics, aerospace engineering, information technology, renewable energy, biotechnology, and healthcare.

To benefit from enhanced CEE incentives, potential investors must satisfy the following criteria: undertake an eligible project focused on a targeted industry, form a partnership with an academic or corporate entity, and establish operations within the boundaries of Chachoengsao, Chonburi, or Rayong.

If you need further information, you may schedule an appointment with one of our lawyers.

FAQ

A BOI company in Thailand is a business approved by the Board of Investment (BOI) for investment promotion. It allows foreign and local businesses to benefit from incentives such as tax exemptions, reduced tariffs, and the potential for full foreign ownership in certain sectors.

A BOI company can enjoy numerous advantages, including tax exemptions for up to 13 years, 100% foreign ownership in certain sectors, exemptions from import duties, and non-tax incentives such as permission to hire skilled foreign workers and to own land.

The BOI promotes businesses across sectors such as agriculture, manufacturing, high-tech industries, digital services, and eco-friendly ventures. Each sector has different eligibility criteria and incentives, including tax exemptions and other fiscal benefits.

The BOI company application process involves submitting an online application via the BOI’s e-Investment Promotion Service, preparing a comprehensive business plan, and undergoing a review process. The approval time depends on the capital investment and project type.

To apply for a BOI license, you must submit a detailed business plan, financial documents, project details, and other necessary paperwork. The application is reviewed by BOI officers, and if approved, you’ll receive various incentives based on the project type and industry.

Yes, in certain industries, foreign investors can own 100% of a BOI company in Thailand. However, specific conditions must be met, such as business activities aligned with BOI-promoted sectors, and, in some cases, foreign ownership is subject to restrictions under the Foreign Business Act.

The minimum investment for a BOI project is typically 1 million Baht, excluding land and operational expenses. However, higher investments may be required for large-scale projects, and applications exceeding 750 million Baht will undergo a more comprehensive review.

BOI companies can benefit from tax incentives such as corporate income tax exemptions for up to 13 years, reduced import duties on machinery and raw materials, and exemptions on profits derived from promoted activities, including advanced technologies and research.

The Eastern Economic Corridor (EEC) includes the provinces of Chachoengsao, Chonburi, and Rayong and is a key industrial zone in Thailand. BOI companies located in the EEC can access expanded incentives, including tax exemptions and reduced tariffs, especially for businesses involved in advanced manufacturing, digital technologies, and renewable energy.

To ensure compliance, it’s crucial to work with legal experts who can navigate the BOI application process and ensure your business complies with all necessary regulations. Benoit & Partners offers expert guidance, from BOI application to ongoing compliance with tax, labor, and investment laws.