Call us now:

Understanding the regulations for Corporate Income Tax in Thailand

Corporate Income Tax (CIT) is a fundamental component of the taxation system governing businesses operating in Thailand. Sections 65 through 76 of the Revenue Code of Thailand define tax obligations, calculation methods, applicable rates, and compliance requirements for companies. These provisions establish the standard CIT rate and deductible expenses as well as tax filing obligations and penalties for non-compliance.

Beyond the general framework provided by the Revenue Code, Thailand offers various tax incentives to promote investment and economic development through the Investment Promotion Act of 1977. This law provides tax exemptions and reductions for businesses receiving Board of Investment (BOI) promotion, especially in targeted industries such as manufacturing, technology, and research and development. Additionally, companies operating as International Business Centers (IBCs) can benefit from preferential tax treatment under Royal Decree No. 674, which offers reduced CIT rates, exemptions on certain income, and other financial advantages aimed at attracting regional headquarters and multinational operations to Thailand.

While the standard CIT rate applies uniformly to domestic and foreign companies conducting business in Thailand, the eligibility for BOI and IBC incentives depends on specific criteria such as the nature of the business, capital investment, and compliance with industry-specific regulations. Businesses seeking to optimize their tax position must carefully assess their qualification for these incentives and ensure compliance with statutory requirements to maintain their tax benefits over time.

This article provides an in-depth examination of Thailand’s standard corporate tax structure, BOI tax incentives, and IBC benefits by outlining key provisions of the Thai Revenue Code as well as eligibility conditions and potential tax planning strategies available for businesses operating in Thailand.

Table of Contents

Entities Subject to Corporate Income Tax in Thailand

Thai-incorporated companies and juristic partnerships

Entities incorporated under Thai law, such as limited companies, limited partnerships, and registered partnerships, are subject to corporate income tax on their worldwide income, with no exceptions for overseas earnings. This includes profits gained internationally as well as within Thailand without exemptions for foreign earnings.

Foreign-incorporated companies and juristic partnerships

Foreign organizations and legal partnerships formed abroad conducting operations in Thailand or earning Thai-sourced income are subject to Corporate Income Tax in Thailand. Even without direct business dealings, companies abroad receiving dividends, royalties, interests or capital increases from the Kingdom are taxed under the nation’s source-centered taxation system. Businesses with staff, agents, or representatives in the country may also be liable for taxation.

Other Taxable entities

Joint ventures functioning in Thailand are seen as separate taxable entities. Government-affiliated overseas businesses engaging in commercial activities within Thailand must also comply with corporate income tax rules. Additionally, foundations and associations that generate earnings are taxable unless expressly exempted by law.

Standard Corporate Income Tax in Thailand

Standard Rate for Corporate Income Tax in Thailand

In Thailand, companies are generally subject to Corporate Income Tax rate of 20% on net profits. This applies to all Thai-registered entities, including subsidiaries of foreign companies.

- Taxable Income Calculations: The Corporate Income Tax in Thailand is levied on the company’s net profit, determined by subtracting eligible expenses and depreciation from gross income.

- Filing Requirements: Companies must file annual CIT returns (PND 50) within 150 days after the end of their accounting period.

Corporate Income Tax in Thailand for Small and Medium Enterprises (SMEs)

Thailand provides preferential corporate income tax rates for small and medium-sized enterprises (SMEs), characterized as companies with paid-up capital not exceeding THB 5 million and annual revenue below THB 30 million. For net profits ranging from 0 to 300,000 THB, the tax rate is 0%. For profits between 300,001 and 3,000,000 THB, the applicable rate is 15%. For profits exceeding 3,000,000 THB, the tax rate is set at 20%.

This incentive encourages business startups and smaller companies during their formative stages.

Withholding Tax and Advance Tax Payments

Companies engaging in payment transfers to foreign parties are subject to a 10-15% withholding tax rate depending on double taxation agreements designed to avoid double taxation. Furthermore, companies must also prepay Corporate Income Tax in Thailand in mid-year (PND 51) based on estimated profits.

BOI Incentives for the Corporate Income Tax in Thailand

The BOI’s Corporate Income tax incentives are authorized under Thailand’s Investment Promotion Act B.E. 2520 and enhanced through the Competitive Enhancement Act B.E. 2560 which offers additional benefits to companies contributing technological advancement or economic growth. Eligible businesses in sectors promoting regional competitiveness and sustainable development may receive tax benefits depending on activity categorization and economic contributions to Thailand.

Under these laws, businesses engaged in activities that promote technological advancement, regional competitiveness, and sustainable growth may qualify for various tax benefits. The eligibility of an enterprise for BOI incentives depends on the category of its activity and the level of its contribution to Thailand’s economic development.

Agriculture and Agricultural Products

The agriculture sector serves as a foundation of Thailand’s economy. The BOI promotes sustainable cultivation, biotechnology, and fooding innovation. Companies investing in agricultural technology or processing can benefit from attractive incentives for the Corporate Tax Income in Thailand.

Up to 8 years of Corporate Income Tax exclusion is granted to businesses involved in biotechnology and agricultural examination. Companies that work on genetic improvement, biofertilizers, and sustainable food creation qualify for the highest incentives. A 5-year Corporate Tax Income exemption applies to companies that concentrate on sophisticated food processing and organic farming. These businesses contribute to food safety and progress.

Mining, Ceramics, and Basic Materials

This category incorporates businesses engaged in mineral extraction, metallurgy, and ceramic production. The BOI aids companies that develop advanced materials and sustainable mining practices.

A 8-year Corporate Income Tax exception applies to businesses involved in the extraction and handling of rare minerals. These resources are indispensable for advanced manufacturing industries. A 3–5-year Corporate Income Tax exemption is available for companies producing high-quality ceramics and metal-based items. This comprises glass, construction materials, and exactness metal constituents.

Light Industry

Light industries concentrate on consumer goods, textiles, furnishings, and eco-friendly manufacturing. The BOI supports investments that promote sustainability and value-added production. In fact, a 3-5 years of Corporate Tax Income exemption is accessible for businesses engaged in eco-friendly textile and garment production. Companies using biodegradable fabrics or sustainable dyeing techniques qualify for tax relief.

Metal Products, Machinery, and Transport Equipment

This category incorporates companies producing industrial machinery, transport equipment, and robotics. Thailand’s automotive and aerospace industries benefit meaningfully from BOI incentives. A 8-year Corporate Income Tax exemption applies to companies developing automation technology, industrial robots, and AI-driven machinery. These investments align with Thailand’s push for Industry 4.0. A 5-year CIT exemption is available for companies producing automobile parts, railway equipment, and aerospace components. Businesses in these sectors benefit from long-term tax relief.

Electronics and Electrical Appliances

Thailand plays a pivotal role in the global electronics supply chain as a key player. The BOI stimulates investment in cutting edge technologies such as semiconductor fabrication, intelligent home appliances, and renewable energy solutions. An 8-year corporate tax exemption is awarded to enterprises involved in semiconductors, printed circuit boards, and sophisticated electronic components. These businesses are indispensable to Thailand’s lucrative export market. A 50% CIT reduction for 5 additional years is available for companies that engage in R&D for smart appliances, IoT devices, and energy-efficient electronics.

Chemicals, Paper, and Plastics

The BOI promotes green chemistry, biodegradable plastics, and industrial paper production. These incentives align with Thailand’s sustainability goals. An 8-year corporate income tax holiday applies to enterprises producing biodegradable plastics, biochemicals, and other eco-friendly materials. A 5-year corporate tax exemption covers industrial paper manufacturing and cutting-edge polymer engineering.

Services and Public Utilities

The services sector plays a pivotal role in Thailand’s economic advancement. The BOI supports ventures in healthcare, education, and renewable energy generation. An 8-year corporate income tax exemption is available for hospitals, biotech research centers, and renewable energy initiatives. A 5-year corporate income tax exemption applies to private universities, international schools, and training centers.

Digital and Software Development

Thailand aims to emerge as a regional leader in digital technologies. The BOI stimulates investment in information technology, financial technology, and cybersecurity A 8-year corporate tax exemption is available for companies developing artificial intelligence, blockchain, and cybersecurity solutions. Those enterprises investing in data centers and cloud computing services receive a 50% corporate tax reduction for 5 additional years following the initial exemption.

Research & Development (R&D) and Innovation

The BOI strongly supports research and development driven ventures, particularly those in biotechnology, nanotechnology, and automation. A 10-year corporate tax holiday applies to companies conducting cutting edge research, biotechnology, and AI powered solutions. 200% deductions for research and development expenses further incentivize additional investment in innovation and emerging technologies.

Additional Deductions applied to the Corporate Income Tax In Thailand

To promote technology and innovation, BOI allows companies to claim extra tax deductions based on specific expenditures. The following classes qualify for these deductions:

- Research, technology progress, and innovation (in-house, outsourced in Thailand, or joint R&D with overseas institutes): 300% deduction

- Donations to technology and human capital progress funds, educational institutes, and R&D centers: 100% deduction

- IP acquisition and licensing fees for commercializing technology developed in Thailand: 200% deduction

- Advanced technology training programs: 200% deduction

- Development of local suppliers with at least 51% Thai shareholding: 200% deduction

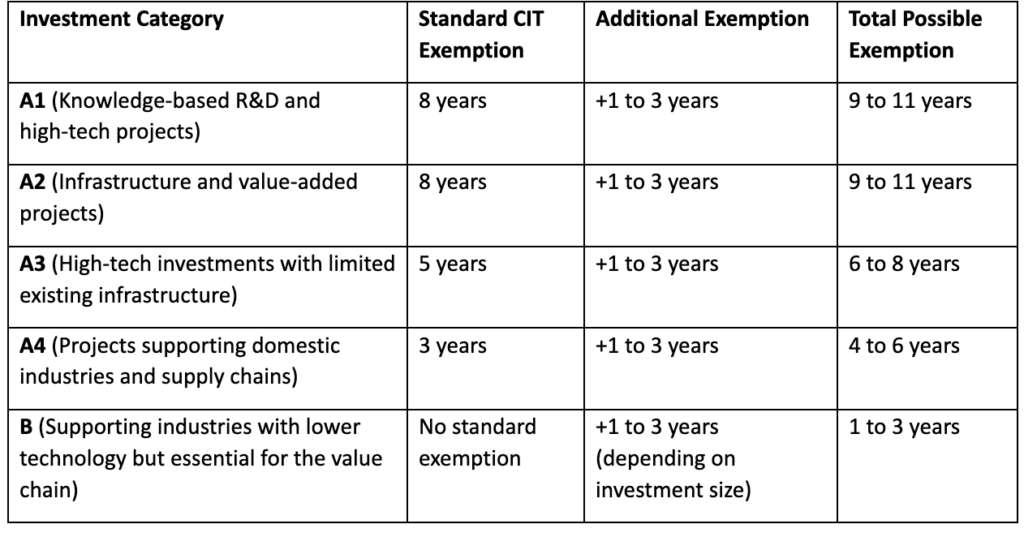

Additional BOI Exemption for Corporate Income Tax in Thailand

In addition to standard tax privileges, companies may benefit from an extended CIT exemption period depending on the investment amount and its impact on competitiveness. The duration of this additional exemption is structured as follows:

- 1-year additional exemption: 1% of the investment amount or at least 200 million THB, whichever is lower.

- 2-year additional exemption: 2% of the investment amount or at least 400 million THB, whichever is lower.

- 3-year additional exemption: 3% of the investment amount or at least 600 million THB, whichever is lower.

These incentives provide long-term tax relief, making Thailand an attractive destination for high-value investments in strategic industries.

Stay compliant with Thailand’s corporate income tax get expert guidance

IBC Incentives for Corporate Income Tax in Thailand

The Revenue Code of Thailand, as amended, governs the establishment and tax treatment of IBCs. To qualify as an IBC, a company must meet the following conditions:

- Corporate Structure: The entity must be incorporated in Thailand under civil law and be registered with the Department of Business Development.

- Primary Objective: The IBC must offer management, technical, or financial services to associated companies. Alternatively, it can engage in international trade.

- Capital Requirements: By the close of each financial year, the IBC is obligated to maintain a minimum paid-up capital of 10 million Thai baht.

- Qualified Personnel: No less than 10 skilled staff must be fully involved in operations. However, for a company acting solely as a treasury center, the minimum is reduced to 5 employees.

- Operational Expenditures: At a minimum, the IBC needs to spend 60 million Thai baht annually on recipients within Thailand.

- Additional Regulations: Further rules and conditions may be imposed by the Revenue Department to ensure tax law compliance.

Failure to satisfy any of these stipulations in a fiscal year could result in the revocation of IBC status and linked tax incentives.

Scope of International Business Center Activities

An International Business Center is authorized to undertake various roles in three primary classifications:

- Management, Technical, and Support Services

An IBC can oversee business coordination and strategic planning in addition to procuring raw materials and logistics. It is permitted to conduct research and development as well as provide technical assistance and personnel training. Moreover, the IBC can offer marketing, sales advisory, human resources management, and financial consulting services. This category also encompasses investment analysis, credit risk management, and compliance oversight. - Treasury Management Operations

An IBC is permitted to centralize cash administration and liquidity planning for its affiliated entities. It can engage in cross-border lending and borrowing in Thai baht, provided that these transactions follow the foreign exchange regulations established by the Bank of Thailand (BOT). Moreover, it is able to conduct foreign currency hedging and execute monetary risk management strategies to mitigate fluctuations in currency and financial unpredictability. - International Trade Center Operations

In the realm of worldwide trade, an IBC can facilitate international procurement and oversee trade-associated logistics. It is allowed to handle warehousing operations, coordinate packaging and labeling, and ensure quality control for exported goods. Additionally, it can manage transport and freight forwarding services, as well as insurance and risk management related to global transactions.

Finally, it is able to offer technical advisory and product support services to enhance international trade operations.

IBC Corporate Income Tax Advantages

The Revenue Department Notification describes tax benefits available to an IBC for a period of 15 consecutive accounting periods, subject to ongoing compliance. These include:

- An 8% Corporate Income Tax on qualifying income if the IBC incurs at least THB 60 million in local expenses.

(ap) A 5% Corporate Income Tax if the IBC incurs at least THB 300 million in local expenses. - A 3% Corporate Income Tax if the IBC incurs at least THB 600 million in local expenses.

- Tax-exempt dividends paid by the IBC to non-resident shareholders on qualifying income.

- A Withholding tac exemption on interest payments made by an IBC’s treasury center for funds re-lent to affiliates.

- An exemption from specific business tax (SBT) on income received by a treasury centre.

To conclude

Understanding the intricacies of Corporate Income Tax in Thailand is pivotal for companies designing financial blueprints in Thailand. The standard Corporate Income Tax rate is at 20%, though reduced rates apply to SMEs and full exemptions are possible through BOI or IBC perks.

By capitalizing on these tax breaks and comprehending reporting obligations, enterprises can maximize their tax outlays, stay competitive, and expand operations seamlessly. Consulting experts well-versed in taxation and regulations is prudent to reap maximum benefits within the law.

For detailed advisory, businesses are best served reviewing Thailand’s Revenue Department and BOI websites regularly for updates on policies and incentives shaping the fiscal landscape. Nuanced tax guidance is critical for long-term strategy as rules occasionally change.