Call us now:

How does debt collection in Thailand work, and what legal remedies can creditors use to recover unpaid debts ?

Debt collection in Thailand follows a strict legal structure governed by the Thai Civil and Commercial Code (CCC) and the Civil Procedure Code (CPC). For any creditor, understanding how debt collection in Thailand works is essential before initiating action, because every step—from issuing a demand letter to enforcing a court judgment—is regulated by procedural rules. Foreign creditors in particular face additional challenges, such as jurisdiction, language, evidence, and formalities for notarised or legalised documents.

Because debt collection in Thailand must comply with mandatory legal requirements, professional assistance is necessary to avoid delays, procedural mistakes, and unenforceable claims. This article explains in detail how the pre-litigation phase, civil court proceedings, interim measures, and enforcement work under Thai law.

Table of Contents

What are the regulations concerning debt collection in Thailand ?

In Thailand, debt collection processes are regulated by various laws designed to protect creditors’ and debtors’ rights. The following are fundamental regulations regarding debt collection in Thailand:

This is the major law governing the collection of debts in Thailand. It legalizes obligations stipulated in a contract, including that of debt repayment. It also lists the rights and obligations that both debtors and creditors have and how restitution gets done.

This sections the debt collection process through bankruptcy and insolvency. It includes the process of referring a debtor to bankruptcy, a receiver’s appointment, and splitting the assets of a debtor among his creditors. Creditors can use bankruptcy as a way of collecting their debts.

This law has clauses designed to protect consumers from questionnaire debt collection. The aim is to prevent creditors or other debt collectors from maintaining unfair relationships with debtors. The law also sets guidelines for the debt collector’s conduct.

This is a government body in charge of ensuring that debt collection is regular in Thailand. They outline the rules and regulations debt collectors should adhere to.

This act governs the protection of personal data acquired during the collection of the debt. This is to prevent the debt collector from harassing the debtors when seeking to collect information about them.

Creditors and debtors should familiarize themselves with these guidelines when collecting debts. The expertise of a lawyer with accounting services in Thailand can be important to help understand the ways through which these laws operate.

What are the requirements ?

Creditors have requirements to observe when conducting debt collection activities in Thailand. The requirements are meant to ensure justice and ethical procedures while considering the rights of the debtors. The following are some of the requirements in Thailand related to debt collection:

- Firstly, the compliance to the law and regulation are paramount. The creditors should know the applicable legalizations that govern debt collection. It may include the civil and commercial code, the consumer protection act and any other applicable act. Ideally, the information will prevent the creditors from legal consequences and ensure fair debt collection procedures.

- Secondly, the documentation and record-keeping process. Creditors should have documented the deb collection process. It entails the original debt agreement, invoices paid receipts, and any other communication related to the debt. The valid debt is another requirement. The creditor must collect a valid and legally enforceable lien. This includes ensuring the debt’s calculation, interest, term, and other considerations from the ground. Written communication is also a requirement. The written communication will ensure record-keeping and proof of the attempt to recover a debt. Debt creditor’s conduct to the debtor. Creditors should treat the debtor responsible with the debt in dignity and fairness. This means that they should not abuse or threaten them, as well.

- Lastly, the creditor should ensure data protection as per the law. They should verify the legality of collecting the debtor’s information. Additionally, they should handle the data processed concerning the data protection act. The creditor should check the requirements for debt collection and seek a contentious lawyer’s advice. An expert lawyer with accounting services can guide the appropriate need to meet and assist with the debt collection process.

What is the procedure for debt collection in Thailand?

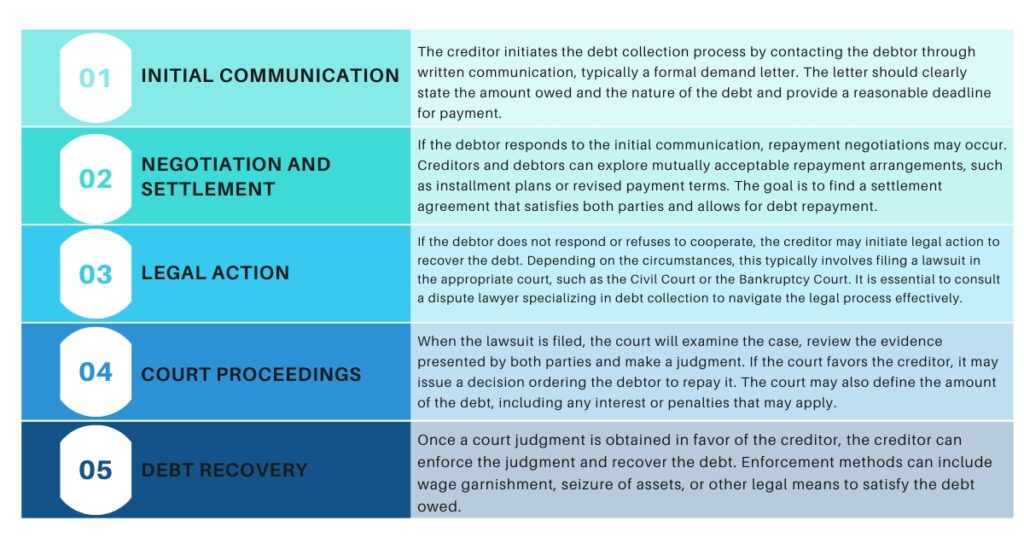

The procedure for debt collection in Thailand typically involves several steps that creditors can follow to pursue the recovery of outstanding debts. While the exact process may depend on the specific circumstances and the nature of the debt, here is a general outline of the debt collection procedure in Thailand :

Get expert legal guidance.

What documents are required ?

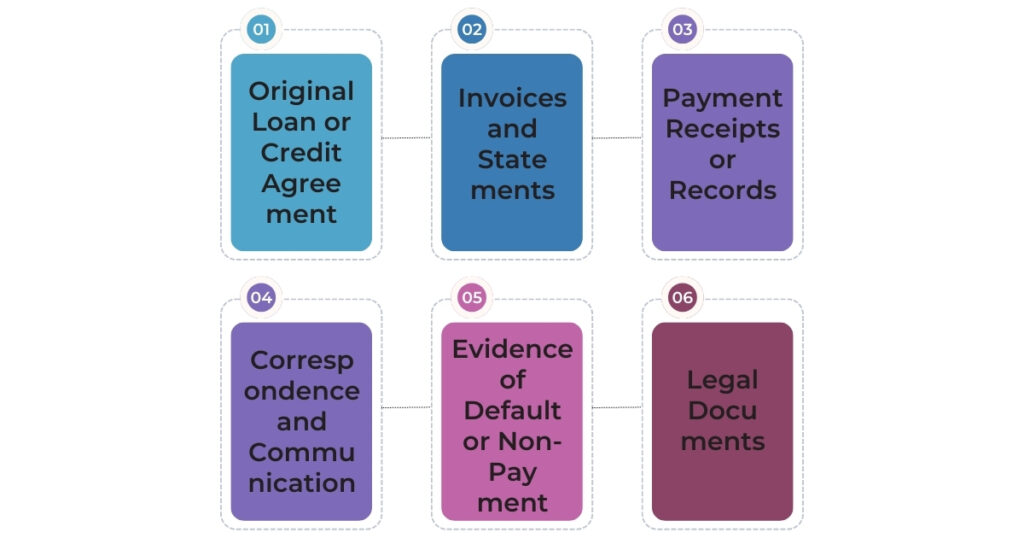

In debt collection cases in Thailand, creditors typically need to gather and prepare certain documents to support their claims and facilitate the debt collection process. While the specific documents required may depend on the debt’s nature and the circumstances surrounding the case, here are some standard documents that creditors may need for debt collection :

For an in-depth understanding of the legal provisions and regulations pertaining to debt collection practices in Thailand, you can refer to the Unofficial Translation of the Debt Collection Act B.E. 2558 (2015).

Conclusion

Creditors who pursue debt collection in Thailand must navigate a procedural system that is technical, document-driven, and strictly regulated. From pre-litigation notices to enforcement through the Legal Execution Department, every stage requires strategic planning and legal accuracy. Because the process involves formalities such as jurisdiction verification, evidence preparation, notarisation, enforcement requests, and possible bankruptcy actions, professional guidance significantly increases the chances of recovering the debt efficiently.

Our legal team assists international and Thai clients with every step of debt collection in Thailand, from drafting demand letters to representing them before Thai courts and enforcing domestic or foreign judgments.

If you wish to secure or recover a debt in Thailand, we can provide tailored advice and a clear strategy adapted to your case.

You can book a free consultation with our firm to receive a personalised initial assessment of your case.

FAQ

Simple cases may be resolved through negotiation within a few weeks, while court litigation generally takes 6–12 months. Complex claims, appeals or enforcement actions may extend the overall process to 18–24 months.

Yes. Foreign creditors can bring claims in Thai courts, provided that foreign documents are notarised, legalised and translated into Thai for evidentiary use.

Not directly. Under Thai law (Section 193/14 CCC), the statute of limitations is interrupted when the debtor acknowledges the debt in writing, makes a partial payment, pays interest, provides security, or when the creditor files a lawsuit. A demand letter alone does not interrupt the limitation period unless the debtor responds with a written acknowledgment of the debt.

Yes. After obtaining a final court judgment, the creditor may request enforcement through the Legal Execution Department, which can seize bank accounts, movable assets or real estate. Enforcement must be requested within 10 years of the final judgment.

Mediation is generally not mandatory in civil debt collection cases, though it may be required in specific cases such as labour disputes. However, Thai courts strongly encourage mediation, and many debt collection cases settle during court-led mediation sessions.