Call us now:

Employee taxation in Thailand

Thailand is considered one of the most vibrant cultures, breathtaking views, and economies, making the country one exciting destination for everyone. But for both employers and employees doing business in Thailand, it is crucial to understand taxation to avoid possible crime and legal issues. As global businesses grow, employee taxation in Thailand becomes an important topic to cover.

Table of Contents

What are the regulations concerning employee taxation in Thailand ?

There are several regulations on employee taxation in Thailand, which regulations are applicable to both employer and employees. Below are some core regulations :

Personal Income Tax (PIT):

Thai residents are taxed on the global revenues under the personal income tax PIT, while non-residents are taxed on Thailand’s source income.

The tax rate is graduated and varies from 0% to a maximum of 35%, depending on the income segment.

The amounts of tax must be withheld by the employer from the employee’s monthly salary and remitted to the revenue authority.

Employees must also file an annual personal income tax return to reconcile all monthly payments and claim any refunds.

Tax Deductions and Allowances:

There are numerous deductions and allowances that employees can claim to prevent from the chopping block, saving some income, some of which are given allowances for healthcare, for education, contribution to the provident fund and social security schemes.

There are further allowances available for number dependent, disabled dependent, and investment in securities.

Social Security Contributions:

The Thailand social security offers several social securities and is distinct for being compulsory to both employees and employers, which benefits also extend to medical, maternity, disablement, old fringe pension benefits.

Deductions are proportionate from the employee’s monthly wage to a maximum specified threshold.

Tax Treaties:

Thailand has tax treaties in several countries to avoid double taxation and reduce the tax burden for employees from foreign countries, entail the legal rules for the taxation of residents in the treaty countries.

Non-resident employees may be exempted from Thai taxation if the employee is only earning an income above some time but is not in Thailand within a particular time.

Compliance and Reporting:

Employee income statement Form PND.1 and .90 is issued to employees and revenue manager by the employer.

Filling and reporting an income tax statement Form PND.91 by the employee.

What law applies?

The Revenue Code is the principal law that applies to employee taxation in Thailand. The Revenue Code is “the prime law governing the taxation system in Thailand, including the personal income tax”.

It provides the rules and regulations under which individual income tax is assessed, calculated, and collected. The Revenue Code includes provisions on several aspects related to employee taxation, including the determination of taxable income, tax rates and brackets, allowable deductions, and allowances. It also specifies the duties and responsibilities of employers and employees in regard to individual employee income tax withholding and remittance to the tax authority.

Apart from the Revenue Code, other laws and regulations may apply to some specific employee taxation aspects in Thailand :

They may be the Social Security Act that specifies the social security system and contributions or double tax treaties between Thailand and other states that present guidelines on the taxation of foreign employees. While performing their activities and duties, employers, employees, and professionals in the taxation field are expected to follow the provisions of the Revenue Code and other relevant laws and regulations, tax notifications, and the Revenue Department of Thailand circulars.

Free

consultation

How is employee tax calculated?

Employee income tax in Thailand, specifically personal income tax (PIT), is calculated based on a progressive tax rate system. Here’s an overview of how employee tax is calculated in Thailand:

1.Determine Taxable Income :

- Start by calculating an employee’s taxable income, which includes salary, bonuses, allowances, benefits-in-kind, and other taxable earnings.

- Certain deductions and allowances may be applicable, such as expenses related to education, healthcare, provident funds, and social security contributions.

- Subtract eligible deductions and allowances from the total income to arrive at the taxable income.

2. Identify Tax Rate Bracket :

- Thailand’s income tax rates are divided into multiple tax brackets, with increasing rates for higher income levels.

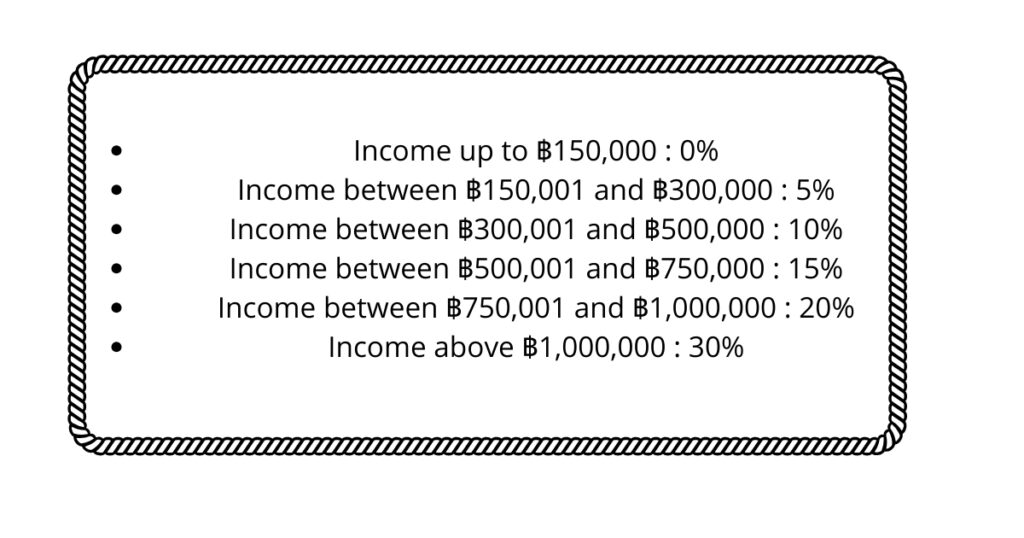

- As of the latest information, the tax brackets and rates are as follows:

3. Apply Progressive Tax Rates :

- Calculate the tax responsibility by applying the applicable tax rate to each income bracket.

- For example, if an employee’s taxable income falls within the 15% tax bracket, the applicable tax rate will be 15% for that portion of the income.

4. Deduct Tax Allowances and Credits :

- After calculating the tax liability based on the progressive tax rates, specific tax allowances and credits may be available to reduce the tax burden further.

- These allowances can include allowances for dependents, disabilities, long-term equity investments, and more.

5. Withholding and Payment :

- Employers are responsible for withholding the calculated income tax from employees’ monthly salaries.

- The withheld tax is then remitted to the Revenue Department by the specified deadlines.

- Employees may also be required to make additional tax payments if their liabilities exceed the amount withheld.

It’s significant to note that tax rates and thresholds may be subject to change, so it’s advisable to consult the latest information and guidelines from the Revenue Department of Thailand or seek professional tax lawyer advice to ensure accurate calculation of employee taxation liabilities.