Call us now:

Setting up a freelance business in Thailand

The landscape of global entrepreneurship keeps evolving, offering the budding business owners a variety of opportunities for professional growth. Since the idea of setting up a freelance business in Thailand has become an increasingly appealing idea for digital nomads and freelancers, an appropriate guide to exploring the specifics of the new business environment must be created. Instructing the novices in the peculiarities of the new country’s regulatory and policy frameworks, helping them build their network and adopt the new business-related cultural values, this article will provide the new business owners with a wealth of information that will facilitate the enhancement of their entrepreneurial skills.

Table of Contents

What are the regulations in Thailand ?

There are a number of precautions that freelance business owners in Thailand should take to ensure they are respecting the law when setting up a freelance business :

- You will need a work permit to operate in Thailand as a freelancer. Though getting a work permit for freelance work is not straightforward, as according to the law, a permit can only be issued under sponsorship of an employer. Since freelancing may fall into a legal ‘grey area’, it’s worth contacting an expert for advice on currently enforced rules.

- Freelance businesses may be obliged to register with the Department of Business Development under the Ministry of Commerce and register their business address . The qualification of which license is required may depend on the exact nature of the freelance work. Freelancers should provide their Thai ID or a passport, a certificate of address, and a statement of activity.

- Thailand-registered freelancers are required to be in taxation systems. Freelancers will need to obtain a tax identification number from the Revenue Department.

- Depending on the income, a freelancer may be required to pay a personal income tax, or, if required by the law, a value-added tax . Freelancers should contact the Revenue Department for more information on their specific nation case, and file taxes annually with the Department. Freelancers will benefit from keeping financial reports to ensure their taxes are accurate.

How to create a company for a freelance business ?

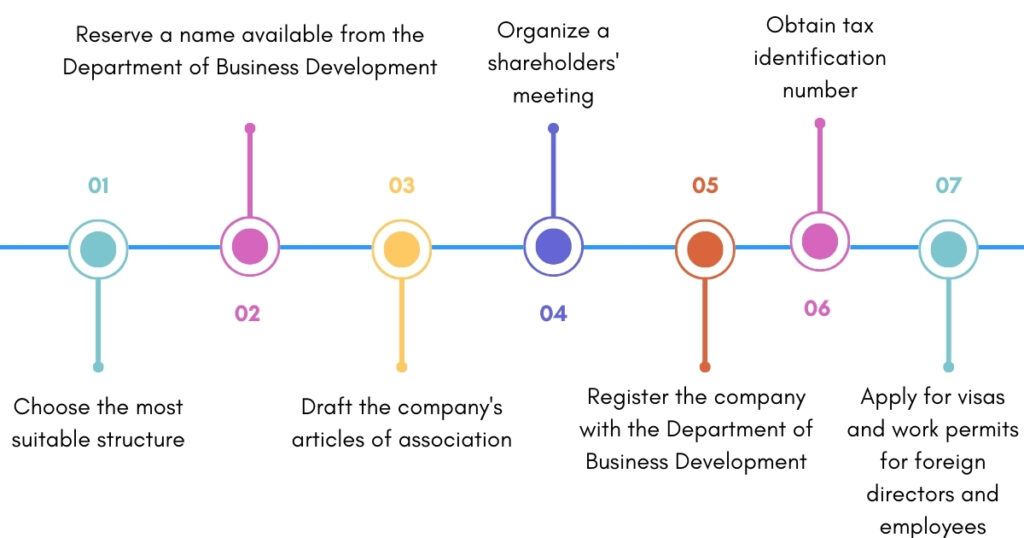

There are seven steps to setting up a company in Thailand :

There are, however, various restrictions on foreigners setting up a business in Thailand. Under the Foreign Business Act of 1982, a foreigner is not permitted to own more than 49% of a Thai company, as a Thai must hold 51%.

In addition to the fact that a foreigner cannot be the sole partner of the company, it is impossible for a person wishing to obtain a work permit to set up a company and hire himself as the sole employee. A company must employ at least four Thai workers to obtain a work permit.

Free

consultation

What activities are prohibited to foreigners or require a license ?

Under the Foreign Business Act, business activity is divided into three categories. The first one comprises nine activities prohibited to foreigners:

Press, radio, and television

Rice cultivation

Cattle breeding

Timber harvesting and carpentry products from primary forests

Fishing

Thai medicinal plant extracts

The sale and trade of antique or historical Thai objects

Manufacture of Buddha image and capture of monastic alms bowls

The sale of land

The second and third categories combine activities for which authorization seek a license. The second category includes six activities requiring a license :

- Banking : The Bank of Thailand (BOT) is the primary national authority supervising, examining, and analyzing banking activities, as empowered by the Financial Institutions Businesses Act B.E 2551 (FIB act). To carry on a banking business, a license must be obtained from the Minister of Finance on the advice of the BOT. According to the FIB act, such a license can only be granted to a public limited company, which is one of the forms of company provided for under Thai law.

- Import-export : This activity is not subject to the Foreign Enterprise Act 1999 restrictions, and a foreigner can hold 100% of the company’s shares. However, a license is required, as the Customs Act B.E 2469 stipulates. Depending on the products to be sold, applications should be addressed to:

- Food and Drug Administration, for pharmaceuticals, foodstuffs, cosmetics, or other hazardous substances.

- Department of Fine Arts, for works of art.

- Ministry of Interior, for weapons, ammunition, explosives, and fireworks.

- National Park Department of Wildfire and Vegetation Conservation, Ministry of Agriculture, or Ministry of Fisheries for commercial activities affecting nature, flora, or marine fauna.

- Restaurants : You must apply to the District Office for a catering license for any restaurant with over 200 square meters of floor area. Smaller establishments need to notify the local authority of their presence.

- Public houses : For an establishment to be able to sell or serve alcohol in Thailand, a license must be obtained from the District Office. This license applies to restaurants, bars, distilleries, importers, distributors, hotels, and nightclubs. However, the establishment must not be near a school or religious temple.

- Hotels : According to The Ministerial Regulation 2008, the Hotel Act 2004, a business is required to obtain a hotel license if the company is considered to be a hotel and if the hotel is not exempt from licensing. Under the Hotel Act 2004, a hotel is any business offering paid accommodation for less than one month. A hotel license is not required if the business:

- Has no more than four rooms on any floor in any building

- Its total capacity is at most twenty guests.

- It is considered a small business offering an additional source of income to the owner.

- Reports its daily rental activity to the government (hotel registrar).

- Legal profession : The Lawyers Act B.E. 2528 (AD 1985) defines a lawyer as “a person who is registered as a lawyer, who holds a license in his or her name issued by the Law Society of Thailand.” To obtain this license, it is necessary to undergo training in professional ethics and the basic principles of advocacy and the legal profession, which is divided into a theoretical part consisting of courses given by the Institute of Law Practice Training of the Law Society of Thailand, and a practical part comprised of working in a law firm for at least six months.

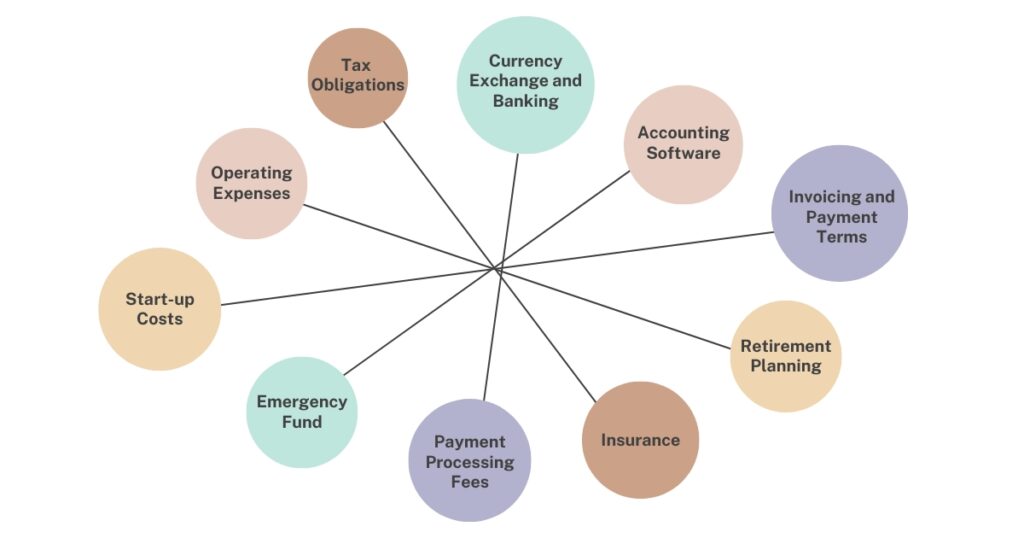

What financial considerations should freelancers keep in mind when setting up a freelance business in Thailand ?