Call us now:

How to open a business in Thailand ?

To open a business in Thailand can truly be an exciting and rewarding venture for entrepreneurs worldwide. Known for its long cultural traditions, breathtaking scenery, and lively urban areas, Thailand offers entrepreneurs a wealth of possibilities across many industries. Whether in tourism and hospitality, which capitalize on the nation’s fame as a premier travel destination, or manufacturing and technology, which gain from Thailand’s strategic placement and robust infrastructure network, a wide range of sectors exist where companies can blossom and succeed.

Table of Contents

What Type Of Business Entity Should You Choose to Open a Business ?

In order to open a business in Thailand, there are several business entities to choose from and each one has its own advantages and disadvantages. These are the most popular types:

Sole Proprietorship

This is the simplest form to open a business entity where a single person operates the business. So, the owner has unlimited liability concerning the business’s debts.

Partnership to open a business

A business operated by two or more people which are involved in sharing the business’s profits and loses. Partners have unlimited liability toward the business’s debts.

Limited Partnerships

It is similar to a partnership but here there are two categories of partners which the ones responsible for the business’s management and the one which are only responsible for their initial investments.

Private Limited Company

This is the most common form to open a business entity used by foreign investors in Thailand. It requires at least 3 shareholders and 1 director. Here shareholders are not responsible with the business’s debts beyond the extent of the initial investments.

Public Limited Company

This company is almost similar to a private limited company the exception is that it ip eligible to offer its shares to the public but as a consequence, it will be subject to more regulations.

Branch office to open your business

A branch office is setup by a foreign company in Thailand and is not a separate legal entity or subsidiary but an extension of the parent company. The branch office is exposed to the entire responsibility of the mother company.

Representative office

It is an office where a foreign company opens in Thailand but which cannot generate incomes or provide services, but it can support the exportation of goods or services.

One must choose the most suitable business entity by considering the number of employees involved, liability level, and the future intentions regarding the investment.

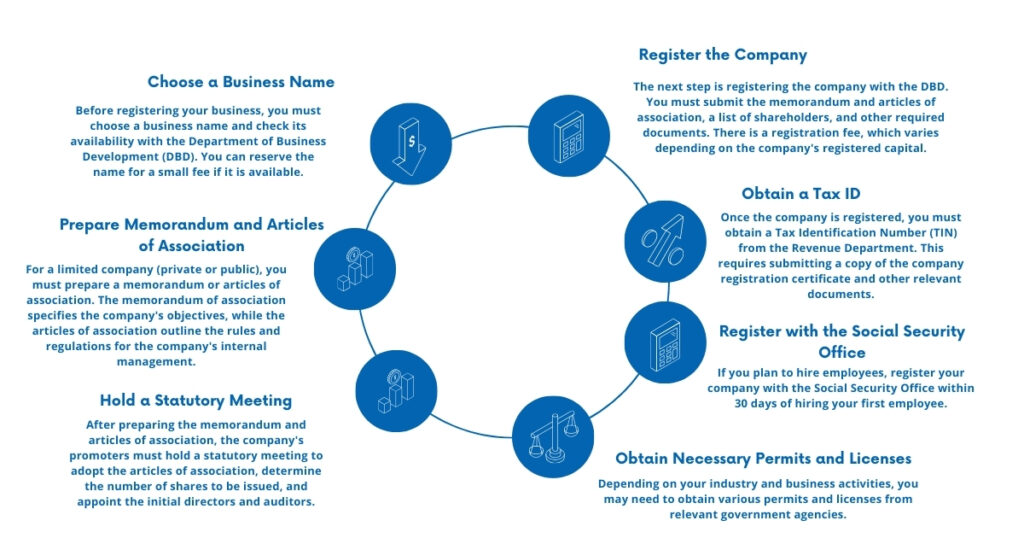

First step to open a business : the registration with the Thai government

When you open a business in Thailand, registering your business with the Thai government involves several steps and requires various documents. The process can depend on the type of business entity you choose, but here’s a general overview :

Get expert legal guidance.

What taxes and fees are associated when you open a business ?

To open a business in Thailand involves several taxes and fees. Some of the most critical taxes and fees for businesses include :

Corporate Income Tax (CIT)

Companies in Thailand are submitted to corporate tax on their net profits at a standard rate of 20%. However, there are reduced rates for companies with taxable income below certain thresholds. For detailed and up-to-date information on Thailand’s corporate tax rules, consult the Revenue Department’s official Corporate Income Tax page.

Value Added Tax (VAT)

Most goods and services sold in Thailand are subject to value-added tax (VAT) at a standard rate of 7%. Businesses are required to register for VAT if their annual sales exceed a certain threshold.

Withholding Tax to open a business

Businesses must withhold tax on certain payments made to employees, contractors, and other service providers. The rate of withholding tax varies depending on the nature of the payment.

Social Security Contributions

Employers must make social security contributions on their employees’ behalf. The contributions are planned as a percentage of the employee’s wages up to a maximum wage base.

Business Registration Fees to open a business

There are fees associated with registering your business with the Department of Business Development (DBD) and obtaining the necessary permits and licenses. The fees vary depending on the type of business entity and the company’s registered capital.

Stamp Duty

Stamp duty is a tax required on specific legal documents, such as contracts, leases, and mortgages. The rate of stamp duty depends on the type of document.

Property Tax

If your business owns property in Thailand, you may be subject to property tax. The property tax rate depends on the location and use of the property.

Import and Export Duties to open a business

If your business is involved in importing or exporting goods, you may be subject to import and export duties. The rates vary depending on the type and value of the goods.

Most of the crucial taxes and fees linked when you open a business in Thailand are outlined above. It is essential to work with a qualified tax professional or accountant from our firm Benoit&Partners to ensure that you fully understand and comply with all applicable tax laws and guidelines.

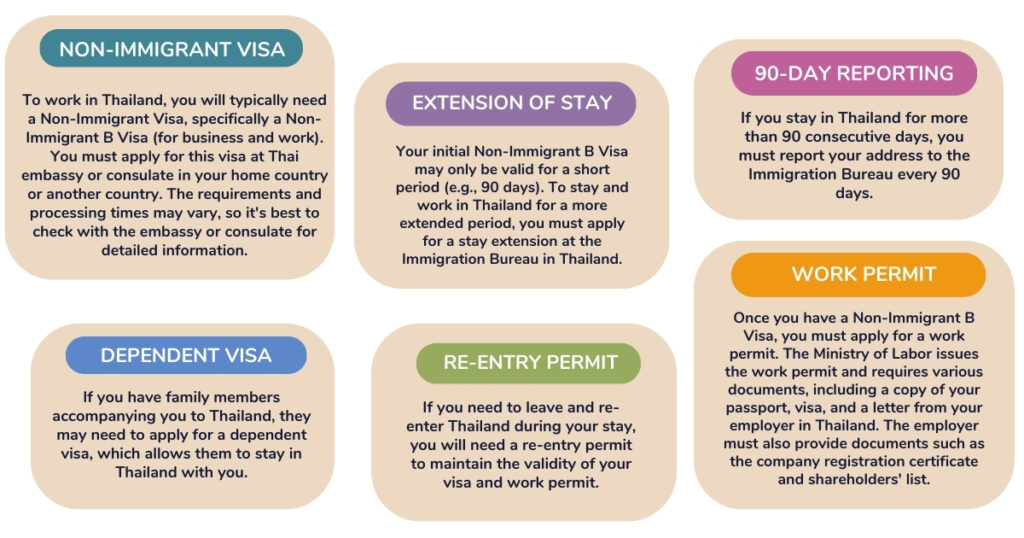

How Can You Obtain The Necessary Visas And Permits To Open A Business In Thailand ?

Obtaining the necessary visas and permits to work in Thailand involves several steps and varies depending on your nationality, the nature of your work, and the length of your stay. Here is a general overview of the process :

In Addition, you must note that the process and requirements for obtaining visas and permits can vary and may change over time. It’s advisable to contact a legal expert or visa consultant from our law firm Benoit&Partners to ensure that you comply with all the requirements and follow the correct process. You should also check with the Thai embassy or consulate and the Ministry of Labor for the most up-to-date information.