Call us now:

Inheritance laws in Thailand.

Inheritance norms represent a significant issue worldwide, as they reflect societal values, legal frameworks, and social standards. Understanding inheritance laws in Thailand is essential for individuals who wish to understand how assets are distributed and how to plan their estates effectively. Individuals must navigate legal rules that determine how assets pass from one generation to another, balance family obligations, and respect personal intentions.

At Benoit & Partners, we guide individuals through inheritance laws in Thailand with clarity and strategic planning. We analyze the Civil and Commercial Code, draft compliant wills, and structure estate plans that respect family obligations while fulfilling personal intentions. Our team manages probate procedures, secures asset transfers, and works to prevent disputes to ensure smooth succession across generations.

Table of Contents

Get expert legal guidance.

What are the regulations in Thailand?

Regulations concerning inheritance law in Thailand are primarily explained in the Civil and Commercial Code. The following is the description of the essential regulations regarding inheritance:

Intestate Succession :

If a person dies without leaving a will, Thai law determines how to distribute the estate. In Thailand, intestate succession follows a statutory hierarchy of relatives. The law recognizes the surviving spouse, children, parents, and siblings of the deceased as primary heirs in that order of priority. If none of these relatives survive, the law allows more distant relatives to inherit according to the prescribed order of succession.

Wills and Testamentary Dispositions :

The right to make a will is a declaration in which a person determines how to distribute their property for the benefit of others after death. As legal scholar Rodgers noted, the testator must prepare the will in writing, either as a public document or a private document. To ensure validity, the will must comply with the formal requirements prescribed by Thai law.

Property Community :

This concept governs the distribution of assets acquired during the marriage. Under this principle, the law treats all property acquired after the marriage as jointly owned by the spouses, unless the parties classify it otherwise. When one spouse dies, the surviving spouse retains ownership of half of the common property, and inheritance rules apply to the remaining half.

Inheritance Tax :

Thailand does not levy an inheritance tax or succession duty on the property leaving to heirs from the deceased. However, it should be recognized that other taxes that relate to transfer issues, or taxing particular sorts of property, may apply in some cases.

Foreign Ownership of Assets :

Foreigners or expatriates who hold assets in Thailand must understand how Thai inheritance laws and the laws of their home country apply to their situation. These legal systems may conflict, and individuals who rely on the wrong set of rules may create invalid or ineffective estate arrangements.

It is always a good idea to consult an experienced lawyer in Thai inheritance law. To point it again, the rules and complexity of inheritance regulations in Thailand depend greatly on the situation and can differ somewhat.

How to get an inheritance in Thailand ?

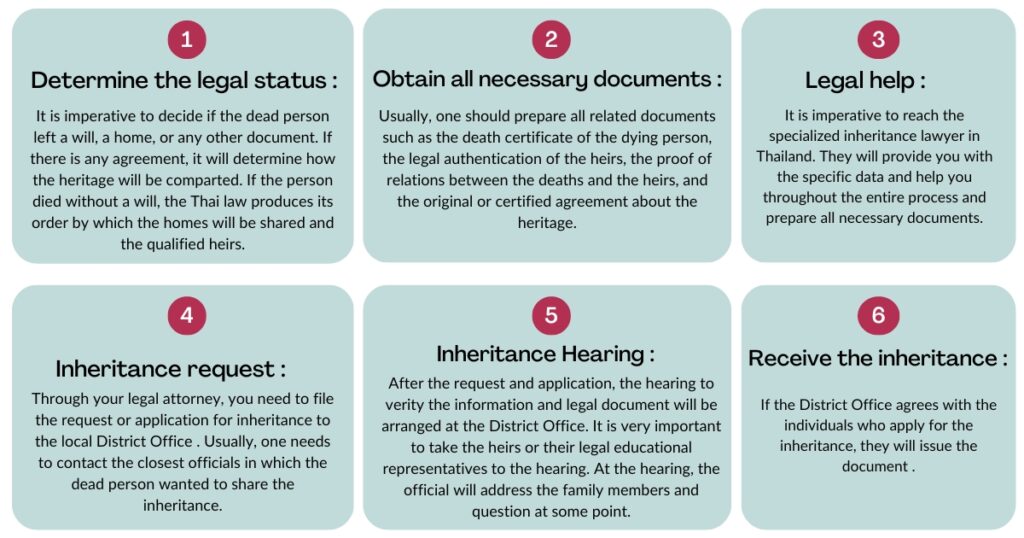

To obtain an inheritance in Thailand, the following general steps can be followed:

Get expert legal guidance.

What are the requirements for inheritance in Thailand ?

In Thailand, the requirements for inheritance depend on various factors, including whether the deceased person left a valid will or died intestate.

Here are the requirements to be met:

- Valid Will: the deceased has left a will or a testament with instructions on how their possessions should be distributed among the heirs. The testament needs to meet the following additional requirements:

The will must be in writing.

The testator must be at least 15 years old and must have legal capacity.

The testator must sign the will and must have at least two witnesses sign it.

The witnesses must sign the will in the presence of the testator and in the presence of each other.Death Certificate:

The heirs must obtain a death certificate to prove that the person has died.Relationship and Identification Documents:

The heirs must provide proof of their relationship to the deceased, such as a marriage certificate, birth certificate, or other official documents. Each heir must also present valid identification, such as a passport or national ID card.Application:

The heirs or their authorized representative must submit a statement or inheritance petition to the local District Office (Amphoe) where the deceased resided or where the assets are located. The application must specify the date and place of death, identify the heirs, and list the assets to be inherited.Intestate Inheritance:

If the deceased left no valid will or if multiple heirs claim rights, the heirs must file an inheritance declaration at the District Office. The heirs or their authorized representative must submit the required forms and supporting documents.Inheritance Certificate:

After the authorities verify the inheritance rights and determine the heirs, the District Office issues an inheritance certificate. This certificate confirms the heir’s legal right to receive the deceased’s assets.The requirements and procedures may vary depending on the circumstances of the case, the District Office involved, and the nature of the assets. Therefore, individuals should consult an inheritance lawyer who understands Thai law to receive advice tailored to their specific situation and to ensure compliance with all legal requirements.

Conclusion

Inheritance law in Thailand provides a structured and transparent approach to the distribution of property upon death. It safeguards the rights of heirs while allowing individuals to plan their estates through valid wills. Whether dealing with intestate succession or cross-border estate issues, inheritance law in Thailand ensures clarity and fairness. Foreigners with assets in the country must also consider how inheritance law in Thailand interacts with international legal systems. Consulting an experienced lawyer specializing in inheritance law in Thailand helps avoid costly errors and ensures smooth estate settlement.

If you need further information, you may schedule an appointment with one of our lawyers.

FAQ

If a person dies without a will, inheritance law in Thailand assigns inheritance according to a fixed order. The surviving spouse and children inherit first, followed by parents, siblings, and other relatives.

Under inheritance law in Thailand, foreigners can inherit assets such as condominiums, vehicles, and bank accounts. However, they cannot own land outright and must sell it or transfer it within one year.

Yes. A Thai will ensures that inheritance law in Thailand governs local assets without conflicting with foreign jurisdictions. It simplifies probate procedures and speeds up estate distribution.

A lawyer familiar with inheritance law in Thailand can prepare wills, represent heirs, manage estate disputes, and ensure all formalities meet Thai legal standards. This expertise ensures efficient and lawful asset transfer in compliance with inheritance law in Thailand.