Call us now:

New tax regulations in Thailand

New tax regulations in Thailand, as outlined in Revenue Department Order No. 161 on 15 September 2023, clarified the legal principles of section 41(2) of the Tax Act. These legislative developments detail the various sources of income that will henceforth be subject to taxation in Thailand, with the aim of clarifying the obligations and procedures associated with identifying the taxable income of Thai tax residents.

For the latest official updates and detailed announcements regarding tax regulations in Thailand you can visit the Thai Revenue Department’s official website, (March 2025).

Table of Contents

What are the new tax regulations in Thailand ?

The new tax regulations targets individuals residing in Thailand who earn assessable income due to work duties, activities abroad, or overseas assets, as per Sections 40 and 41 of the Revenue Code. It emphasises that any assessable income brought into Thailand during any tax year must be declared and included in the calculation of income tax.

- Clause 1: “Persons who are residing in Thailand according to Section 41, paragraph three, of the Revenue Code, who have assessable income due to work duties or activities performed abroad or because of assets located abroad according to Section 41, paragraph two, of the Revenue Code in the said tax year and has brought that assessable income into Thailand in any tax year, that person has a duty to bring that assessable income to be included in the calculation to pay income tax according to Section 48 of the Revenue Code in the tax year in which the assessable income was brought into Thailand.”

- Clause 2: “All rules, regulations, orders, letters responding to consultations or any practices that are contrary or contradictory with this order shall be cancelled.”

- Clause 3: “This order shall come into effect for assessable income imported into Thailand from 1 January 2024 onwards.”

What does it mean to be a “resident” under these regulations ?

A “resident” in Thailand is defined as someone who stays in Thailand for 180 days or more during a tax year, from January 1 to December 31, regardless of nationality. Being classified as a resident affects tax obligations, particularly in how foreign-sourced income is taxed when it is brought into Thailand.

Types of assessable income taxed under the tax regulations in Thailand ?

Under Thailand’s Revenue Code, particularly Section 41, Paragraph Two, foreign-source income that is subject to personal income tax includes several specific categories as outlined in Section 40. These categories cover a wide range of income types, ensuring comprehensive taxation of various income streams that Thai residents may receive from abroad. Here’s a breakdown of what is included under Section 40 (1) to (8):

- Employment Income (Section 40 (1)): Salaries, wages, bonuses, and other compensation for services rendered.

- Positional Income (Section 40 (2)): Fees for holding positions such as directorships.

- Service Income (Section 40 (3)): Payments for consulting and freelance services.

- Intellectual Property Income (Section 40 (4)): Royalties from copyrights, patents, and trademarks.

- Interest Income (Section 40 (5)): Interest from deposits, bonds, and other financial instruments.

- Dividend Income (Section 40 (6)): Dividends and profit shares from companies.

- Rental and Property Income (Section 40 (7)): Income from leasing property and other real estate benefits.

- Other Gains (Section 40 (8)): Pensions, annuities, and other periodic benefits.

Which funds are taxable in Thailand ?

To ensure compliance with Thailand’s new tax regulation, it’s important to identify which funds will be considered taxable when brought into the country under the updated guidelines:

- Interest Income: Interest earned from foreign sources and brought into Thailand in the tax year it’s received, provided the individual has been in Thailand for at least 180 days.

- Dividend Income: Dividends from foreign sources brought into Thailand, generated from January 1, 2024, onwards.

- Rental Income: Rental income from foreign properties transferred into Thailand during a tax year where the individual meets the residency criteria.

- Business Income: Profits earned from business activities conducted abroad and brought back into Thailand if generated from January 1, 2024, onwards.

- Capital Gains on Stocks Sold: If stocks purchased abroad are sold and the proceeds are brought back to Thailand starting from January 1, 2024

Get expert legal guidance.

Which funds are not taxable in Thailand ?

To help navigate the complexities of Thailand’s updated tax regulations, here is a clear outline of the types of funds that are exempt from taxation when repatriated to Thailand:

- Previously Earned Income: Money earned before January 1, 2024, but brought into Thailand afterwards is not taxable.

- Principal Amount in Investments: When transferring investment funds abroad and then repatriating them back to Thailand, the principal amount returned is not considered assessable income.

- Unrealized Gains on Stocks: Increases in stock values not realized through sale are not taxable.

- Earned Income During Non-Residency: Money earned while the individual was not considered a resident (less than 180 days in Thailand) and later brought into Thailand.

Tax Regulations for the income from Thailand

Navigating tax regulations in Thailand can be complex, particularly when it comes to understanding how various sources of income are taxed. For anyone dealing with or planning to repatriate funds, here’s a detailed guide on the taxation landscape fro the income from Thailand:

- Rental Income: Income derived from property rentals within Thailand is subject to personal income tax. The progressive tax rates range from 5% to 35%, depending on the amount of rental income and property type. Deductions for property-related expenses are permissible, which can reduce the taxable amount.

- Salary from Employment: Salaries earned in Thailand are also taxed at progressive rates ranging from 5% to 35%. This includes social security contributions that vary based on salary levels and employment type.

- Interest Income: Interest from Thai sources like savings accounts or fixed deposits incurs a 15% withholding tax, deducted at source by financial institutions.

- Dividend Income: Dividends from Thai companies are subject to a 10% withholding tax. This rate can be reduced if a tax treaty exists between Thailand and the recipient’s country of residence.

- Capital Gains: Generally, capital gains from the sale of securities listed on the Stock Exchange of Thailand (SET) are exempt if held for over a year. However, gains from unlisted securities or real estate are taxed at progressive rates.

- Business Income: Income from business operations in Thailand faces a corporate tax rate of 20%, applicable to both local and foreign companies. Business-related expenses are deductible.

- Royalty Income: Royalties from the use of intellectual property in Thailand are taxed at withholding rates of 3% to 15%, depending on the intellectual property type and the recipient’s residency status.

- Other Income: This includes earnings from professional fees, commissions, and bonuses, which are taxed similarly to rental and salary income, following the progressive rate structure.

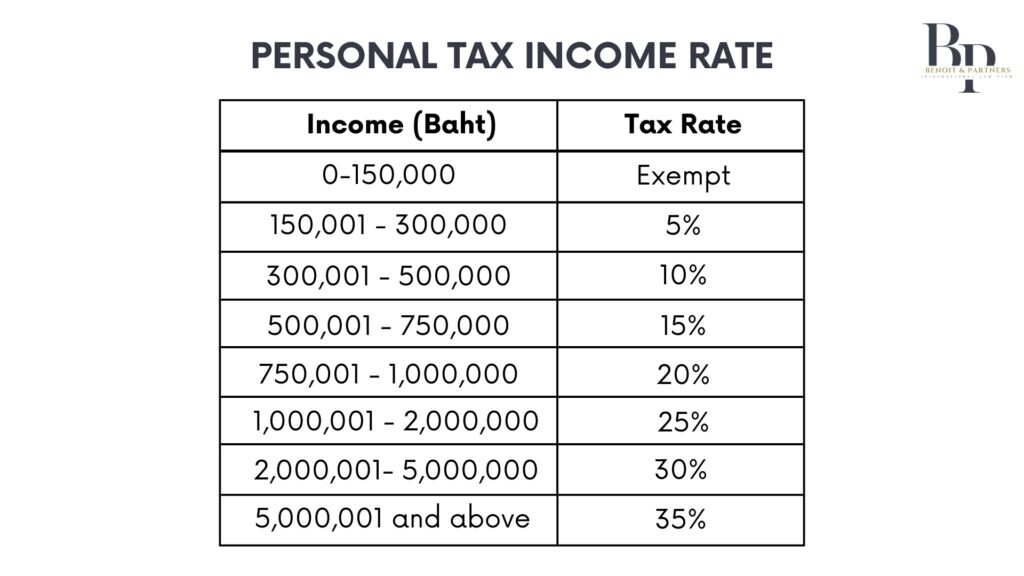

Additionally, the rate of Personal Income Tax is provided below :

What are DTA’s and how does it facilitate foreign tax deductions under the tax regulations in Thailand ?

A Double Taxation Agreement (DTA) is a treaty between two countries aimed at preventing taxpayers from being taxed twice on the same income. Thailand has established DTAs with several countries to promote international trade and investment by providing clarity and certainty on tax matters. Under a DTA, when a taxpayer earns income in one country but is tax resident in another, the treaty determines which country has the primary right to tax that income, typically the country of residence. Key aspects of DTAs include:

- Allocation of Taxing Rights: DTAs specify which of the two countries has the right to tax specific types of income. While the source country often retains the right to tax income generated within its borders, the country of residence usually has the primary or exclusive right to tax such income, depending on the treaty provisions.

- Tax Credits and Exemptions: To avoid double taxation, DTAs allow taxpayers to claim a credit for taxes paid abroad against their tax liability in their home country. This means if a Thai resident pays tax on income in another country with which Thailand has a DTA, they can potentially offset that tax against their Thai tax due on the same income.

Does the DTA prevent double taxation in this tax regulation ?

Yes, DTAs prevent double taxation by clarifying tax jurisdiction between countries, usually where a taxpayer earns income in one country and is also taxed on that income by another country, usually their country of residence. These agreements detail:

- Jurisdiction Over Taxable Income: DTAs determine which country has the jurisdiction to tax specific types of income based on where the income is sourced and the taxpayer’s residency status.

- Mechanisms to Prevent Double Taxation: Typically, DTAs provide mechanisms such as tax credits—where tax paid in one country can be credited against the taxes owed in the taxpayer’s country of residence—to ensure income is not taxed twice.

By these means, DTAs help manage taxes for people and companies doing business internationally, making sure taxes are fair and supporting global cooperation.

What is “credit of tax” ?

In international tax regulations, the “credit of tax” is a key method to prevent paying tax twice on the same income. This approach allows individuals and companies to reduce their tax bills in their home country by the amount they’ve already paid in taxes abroad. Such tax credits are important for ensuring fairness, especially under agreements between countries that aim to simplify tax rules across borders. By using these tax credits, taxpayers can avoid double taxation, making it easier and more equitable to do business internationally.

New Thai tax regulations implications on taxpayers

The new tax regulations in Thailand brings several implications for taxpayers. Residents of Thailand are now required to declare any income derived from work duties, business activities, or assets situated abroad. Additionally, income brought into Thailand within the tax year must be accounted for in the income tax calculation, following Section 48 of the Revenue Code. Furthermore, any existing practices conflicting with this law are annulled, ensuring consistency and conformity in tax regulations in Thailand.

Conclusion

The new tax regulations in Thailand, effective from January 1, 2024, mark a major shift in how foreign-sourced income is treated for residents. Under Revenue Department Order No. 161, Thai tax residents are now required to declare and pay tax on any income brought into Thailand during the same tax year it was earned abroad. These reforms underscore the importance of understanding one’s residency status, income classification, and the role of Double Taxation Agreements (DTAs) in avoiding duplicate taxation. As Thailand continues to align with global tax transparency standards, seeking professional advice from legal and tax experts is the most effective way to ensure compliance and minimize risks.

Frequently Asked Questions

The regulations apply to Thai tax residents—anyone residing in Thailand for 180 days or more within a calendar year—who earn income abroad and bring it into Thailand in the same tax year. This includes employees, investors, business owners, and retirees.

All assessable income earned abroad and repatriated to Thailand during the same tax year is taxable. This includes salaries, dividends, interest, rental income, business profits, and capital gains generated after January 1, 2024.

Yes. Income earned before January 1, 2024, but brought into Thailand afterward is not taxable. Similarly, principal investment amounts and unrealized gains remain exempt, as well as income earned during periods of non-residency (less than 180 days in Thailand).

DTAs prevent individuals and companies from being taxed twice on the same income. They establish which country has the right to tax specific income types and allow taxpayers to claim credits in Thailand for taxes already paid abroad, ensuring fair and balanced taxation across jurisdictions.