Call us now:

Shareholders disputes in Thailand

Thailand ranks among the countries where a flourishing and dynamic business environment attracts numerous investors. However, shareholder disputes in Thailand occasionally arise and create significant challenges for both companies and the individuals involved. When shareholders of a company enter into conflict, they affect performance, hinder growth, and create an adverse business environment. In Thailand, business owners and investors must understand the causes of these disagreements, the existing legal framework, and the effective strategies available to resolve them in order to ensure smooth operations and prevent stakeholder-related problems.

At Benoit & Partners, we resolve shareholder disputes in Thailand with decisive and strategic legal action. We identify the root causes of conflicts, enforce shareholder rights, challenge unlawful resolutions, and initiate mediation or litigation when necessary. Our team structures robust agreements, protects business continuity, and restores corporate stability to safeguard both company performance and investor interests.

Table of Contents

What are the regulations concerning shareholders dispute ?

In Thailand, shareholders dispute regulations are mostly governed by the Civil and Commercial Code and the Securities and Exchange Act. Order to resolve any conflicts that might arise and to ensure preservation of shareholders’ rights there are a number of rules put in place. Some of the key points regarding such rules are:

Shareholder Agreements :

Shareholders may enter into agreements that regulate their rights and duties vis-à-vis the company. These agreements may address the number of shares owned, voting rights, the dividend process, company management, and, most importantly, dispute resolution methods. These agreements serve as a common and important mechanism for resolving disputes because they impose legal obligations on the parties to perform specific duties.

Corporate Governance :

The Civil and Commercial Code and the Securities and Exchange Act regulate corporate governance matters. These rules aim to ensure fair and transparent company operations. They regulate the duties and rights of the company, directors, and shareholders and provide a legal basis in cases involving breaches of fiduciary duties or improper conduct.

Share Valuation :

Disputes often arise during the transfer, purchase, or acquisition of shares, as well as in situations involving share dilution. Differences of opinion regarding the value of shares and ownership stakes may cause these disputes. The Civil and Commercial Code provides mechanisms to determine the fair value of shares. Parties may resolve such disputes by involving experts and clearly defining the valuation methods to apply.

Mediation, Arbitration and Litigation :

The legal framework recognizes several methods for resolving disputes peacefully and lawfully. Mediation involves a facilitator who assists the parties in reaching an agreement; however, it does not create a binding resolution unless the parties formalize it. Arbitration constitutes a formal process in which an arbitrator or arbitration panel issues a binding decision based on the arguments and evidence that the disputing parties present. Litigation serves as the final resort, where the courts resolve the dispute.

Minority Shareholders Protection:

The law provides specific measures and tools to protect minority shareholders. The legal framework safeguards minority shareholders against oppressive or unfair conduct by majority shareholders or managers. These protections include the right to challenge or object to unlawful actions, seek remedies for breaches of rights, and request an inquiry into the company’s business operations.

Get expert legal guidance.

What law applies ?

In Thailand, the laws that are mainly applicable for the shareholders dispute of interest are the Civil and Commercial Code and the Securities and Exchange Act. Those laws are regulating the general legal framework governing the shareholders’ conflict of interest and their rights. Below is a brief description of these fundamental laws. The Civil and Commercial Code is the main civil law of Thailand, defining legal relationships related to contracts, property, obligations, business entities and company registration. This law also describes partnerships, limited partnerships, and private and public companies’ means, formation, operation, and liquidation, and the shareholders’ rights and duties. The relevant parts of it include :

First, Sections 1096 to 1266 regulate partnerships, limited partnerships, and private limited companies.

Second, Sections 1267 to 1493 govern public companies, including their purpose, formation, and management, and define shareholder rights and duties.

Third, Sections 1501 to 1547 regulate share transfers, the issuance of share certificates, and related shareholder matters.

The Securities and Exchange Act regulates the issuance, trading, and disclosure of securities. It also governs public companies and seeks to protect investors in the securities market while ensuring fair and transparent access to capital. The relevant parts of this Act include:

Part 3: Regulates public companies, including shareholder meetings, voting procedures, and disclosure obligations.

Part 8: Establishes penalties and enforcement measures for violations of the Securities and Exchange Act and provides mechanisms to address securities fraud, insider trading, and market manipulation.

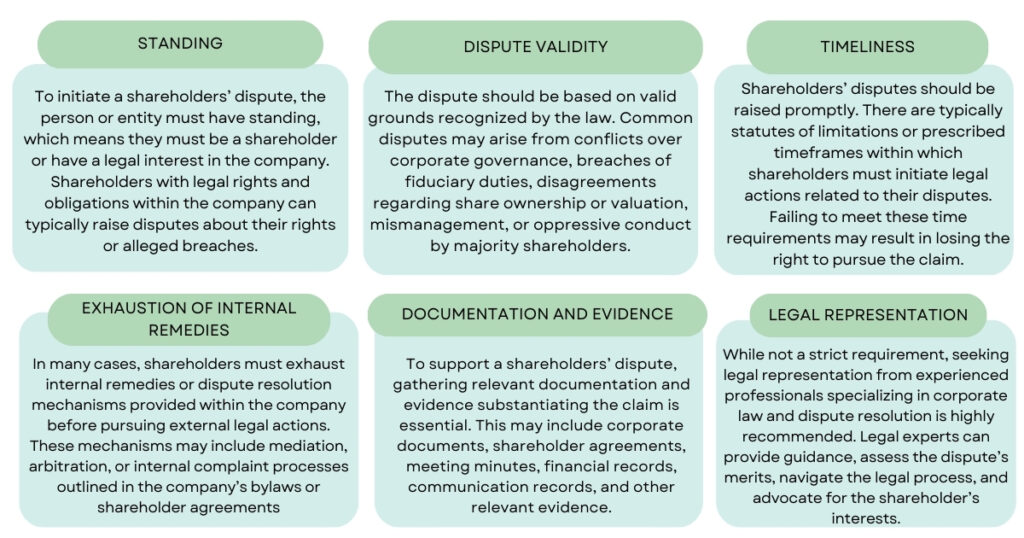

What are the requirements for shareholders dispute ?

Regarding shareholders dispute in Thailand, there are specific requirements and considerations to be aware of. While specific requirements can vary based on the conflicting nature and the applicable laws, here are some general aspects to consider :

Get expert legal guidance.

Conlusion

Shareholder disputes in Thailand can seriously affect a company’s operations and growth if not properly managed. However, the Thai legal framework, mainly the Civil and Commercial Code and the Securities and Exchange Act, provides clear rules governing shareholder rights, corporate governance, share transfers, and dispute resolution mechanisms.

Through well-drafted shareholder agreements, transparent management practices, and access to mediation, arbitration, or litigation, conflicts can be effectively addressed. Ultimately, understanding the legal framework and implementing preventive safeguards are essential to protecting shareholder interests and ensuring business stability in Thailand.

If you need further information, you may schedule an appointment with one of our lawyers.

FAQ

The Thai Civil and Commercial Code governs private companies, and the Securities and Exchange Act regulates public companies and securities matters.

Disputes often arise from disagreements over voting rights, dividend distribution, share transfers, management control, or alleged breaches of fiduciary duties.

Yes. Shareholders can sign agreements that define voting rights, share transfers, and dispute resolution mechanisms, and Thai courts generally enforce them if they comply with the law.

They may use mediation, arbitration, or litigation. Arbitration produces a binding decision, while courts handle cases when other methods fail.

The law allows minority shareholders to challenge unlawful resolutions, request investigations, and seek remedies for oppressive or unfair conduct.

They must present evidence of legal violations, breach of duties, or infringement of shareholder rights under Thai corporate and securities laws.