Call us now:

Tax declaration in Thailand

The Thai Tax Act of 1938 governs Tax declaration in Thailand. Two basic taxes are direct and indirect, respectively. Direct taxes are tariffs on white spirits, personal income, corporate income, and the like. Indirect taxes include value-added taxes, excise taxes, customs duties, petroleum taxes, stamp duties, and specific trade taxes. Income tax is based on self-assessment. Normally, the tax and taxpayer’s financial records are reviewed one year after filing. VAT is levied on the consumption of goods and services, including the imported goods.

Table of Contents

What are the regulations concerning tax declaration in Thailand ?

The rules controlling levies in Thailand can be intricate. There exist ten things to take into account regarding tax reporting duties:

Individuals and organizations within Thailand’s borders must obtain a unique identifying number, commonly called a Taxpayer Identification Number or TIN, before submitting returns.

The tax year spans January 1st through December 31st. Submissions are expected by late March or early April of the subsequent year.

The primary levies embraced encompass personal and corporate income taxes, specific business assessments, value-added taxes, and withholding obligations.

Persons earning wages within Thailand endure personal income taxes. Progressively higher brackets ranging from nil to 35% depend on one’s annual income.

Companies functioning inside Thailand confront corporate income taxes, ordinarily 20% of net profits though certain industries may qualify for incentives altering this rate.

Value-added taxes of 7% generally apply to goods, services, or imports but exemptions exist.

Specific business taxes varying from 0.1% to 3.3% depend on banking, financing, securities, insurance, or some services.

Withholding duties collect taxes at the source of earnings like salaries, freelance charges, dividends, or royalties as determined by payment kind.

Taxpayers must submit returns to the Thai Revenue Department in forms distinguishing individuals from companies and taxes owed. Payments accompany submissions.

Penalties like fees and interest charges could result from noncompliance or tardiness so responsibilities must be satisfied by deadlines to avoid potential consequences

What law applies to tax declaration in Thailand ?

Tax declaration in Thailand falls under the jurisdiction of the Revenue Code, the primary legislation establishing the framework for the country’s tax system. The Code outlines an array of taxes from personal income to VAT and withholding, as well as taxpayers’ associated rights, obligations, and the Revenue Department’s authority over assessment, collection, and enforcement.

Additionally, regulations and ministerial notifications provide supplementary guidance on specialized areas. Rules govern exemptions, incentives, and double taxation agreements while also addressing complex matters including transfer pricing. The Code thus serves as the central foundation on which Thailand’s taxation policies are built.

It is crucial to note that tax laws continually evolve. New bills are passed and existing provisions amended, emphasizing the importance of consulting professionals and official sources to maintain comprehension of the current statutes. While the Code delineates widespread taxes and general compliance, constant changes require persistent research.

Therefore, engaging tax experts represents the most reliable approach for thorough understanding of Thailand’s taxation legislation in its applicable form.

What is the amount to be paid for personal income tax ?

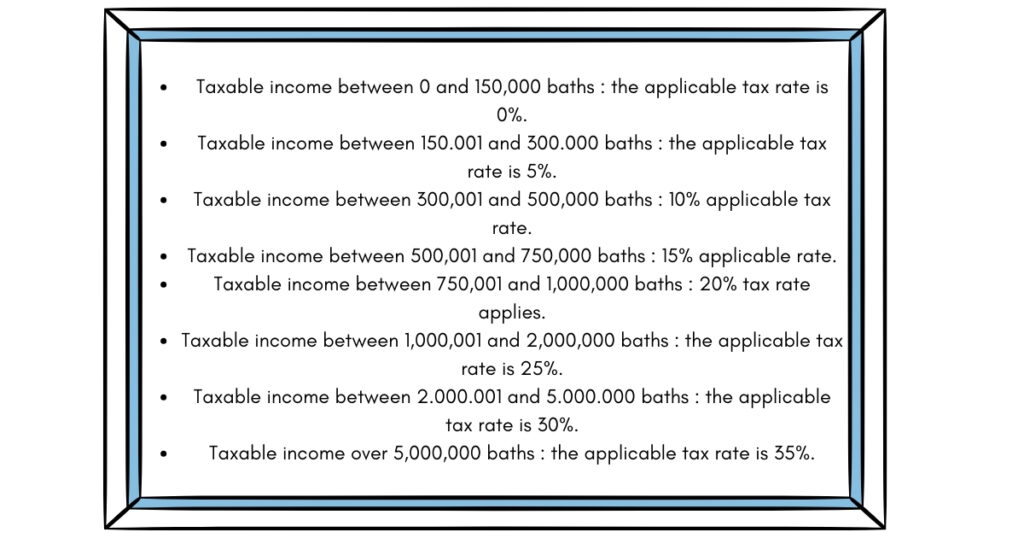

The Tax Code establishes a progressive tax schedule, the amount of which is calculated as follows:

How do you file a personal income tax return ?

It is essential to submit a tax return and payment to the tax office before 31 March of the year, which follows the tax year, using the form “PND 90”.

How much company income tax do I have to pay ?

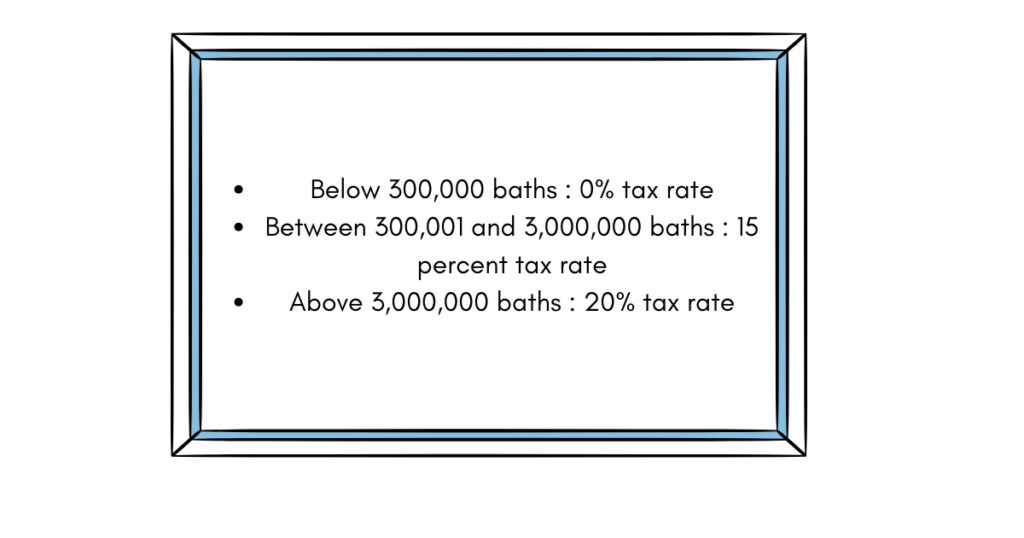

The Tax Act sets out the tax rates used to calculate the tax. In Thailand, the standard corporate tax rate is 20%. However, progressive tax rates apply to small and medium-sized businesses:

How to file a corporate tax return ?

First and foremost, approved annual accounts are crucially important. Within four months of the close of the fiscal period, the accounts are brought before shareholders for ratification at a general meeting. Once authorized, these reports containing a thorough accounting of company finances must then be submitted electronically to tax authorities within the subsequent month.

Secondly, five months after the conclusion of the accounting period, the corporate income tax return form, known as PND50, is due to the tax agency. This vital document requires detailed reporting of the past year’s profits and losses. Careful precision is necessary for accuracy.

Lastly, before the thirty-first of August, mid-year earnings for the first half of the tax year must be disclosed to officials using another submission, PND 51.

What happens if you fail to comply with the law when making your tax declaration in Thailand ?

Failure to comply with Thailand’s tax laws and regulations when filing one’s tax return can result in various consequences and penalties. The exact penalties depend on the nature and seriousness of the noncompliance. Here are five potential outcomes for not adhering to tax laws in Thailand:

- Late Submission Surcharges: If you submit your tax return past the deadline, penalties in the form of daily or percentage-based charges correlating to the lateness could apply. The longer the delay, the costlier it becomes.

- Delayed Remittance Fees: Only paying taxes on schedule exempts one from additional charges. However, percentages are levied per month or part thereof for overdue payments. Interest also accumulates.

- Interest Accrual: In addition to penalties, interest accrues monthly on outstanding tax amounts at rates set by the Revenue Department. It compounds costs over time.

- Audits and Reassessments: Noncompliance increases audit risks during which tax authorities scrutinize records and may issue further assessments with extra taxes, penalties, and interest for discrepancies or underreporting.

- Legal Ramifications: For severe noncompliance like deliberate evasion or fraud, criminal charges, fines, even imprisonment could result following prosecution.

It’s important to note penalty and consequence specifics depend on circumstances and seriousness. To avoid issues, meet obligations accurately and timely, maintain documentation, and seek advice professionally when needed.

For more detailed information and access to official tax forms, deadlines, and online services, you can visit the Thai Revenue Department’s official website.