Call us now:

Tax income in Thailand: Regulations, strategies and support

Businesses and individuals operating in Thailand need to understand the tax income in Thailand. In particular, the Thai Revenue Code primarily governs the tax income in Thailand. It applies to income earned within Thailand and is subject to specific regulations that dictate the calculation of taxable income, allowable deductions, and applicable rates.

In addition to the standard corporate tax rate, businesses may also benefit from a variety of exemptions and tax reliefs. These become available if they meet specific criteria outlined in Thai law, such as the Investment Promotion Act and relevant government policies.

At Benoit & Partners, we provide tax and income services in Thailand to help clients manage the complex regulatory environment. Our team offers practical solutions for tax planning, compliance, and optimization, helping businesses manage their tax liabilities efficiently. Whether you are setting up a new business, seeking tax reliefs, or looking to optimize your tax position, we are here to help. In addition we guide you through the whole process, ensuring full compliance with Thai tax laws while maximizing potential savings.

Get expert legal guidance.

Table of Contents

Why is a balance sheet important for businesses in Thailand?

A balance sheet is indispensable for businesses in Thailand, as with any other nation, for several reasons. First, it offers a snapshot of a company’s fiscal stance at a specific moment. Additionally, it summarizes assets, liabilities, and equity owned and owed. This grants stakeholders a lucid portrait of its financial standing.

- Stakeholders, such as backers, creditors, and administration, use the balance sheet to evaluate an enterprise’s fiscal soundness and stability. It helps comprehension of general solvency and liquidity.

- Creditors, like banks and providers, use the balance sheet to assess creditworthiness. They evaluate a companys ability to meet short-term and long-haul obligations, which is essential when extending credit. Furthermore, companies in Thailand also use the balance sheet for strategic planning. It helps leadership make educated choices regarding capital structure, financing, and investment activities.

- Accounting benchmarks and regulatory bodies regularly require businesses to prepare and present a balance sheet. Therefore, businesses must adhere to these principles for lawful and administrative reasons.

Executives and administrators use the balance sheet as an apparatus for decision-making. It provides important data for allotting assets, making venture choices, and planning for eventual fate. In summary, a balance sheet serves as a basic monetary record. It provides insights into an enterprise’s budgetary wellbeing, strength, and presentation. It serves as a establishment for decision-making and is fundamental for keeping up transparency and liability to stakeholders in Thailand and past.

How are balance sheet services typically provided in Thailand?

Businesses in Thailand can handle balance sheet services through numerous avenues. These depend on a company’s preferences and capabilities. External accounting firms, specialized service providers, in-house teams, consultants, advisors, software, and educational resources contribute to the financial reporting landscape.

- Accounting professionals throughout Thailand assist variously sized businesses with generating compliant balance statements.

- Smaller enterprises may outsource preparation to affordable outsourced accounting services, which allows focus on core operations.

- Mid-sized companies frequently work with external CPA firms. These firms bring skilled accountants and rigorous auditing, which ensures adherence to standards.

- Larger corporations typically maintain internal divisions. These divisions handle accurate financial tracking and statement development.

- Technological automation and accounting software streamline reporting workflows for many.

- Educational institutions additionally offer instructional resources to educate on proper practices. Industry associations and regulatory bodies also provide important guidance. Certain filings demand government submission and conformance with directives.

Overall, Thailand’s financial industry offers a diversity of services. These services support transparent and strategic fiscal management through competently assembled balance sheets.

Who is subject to corporate income tax in Thailand ?

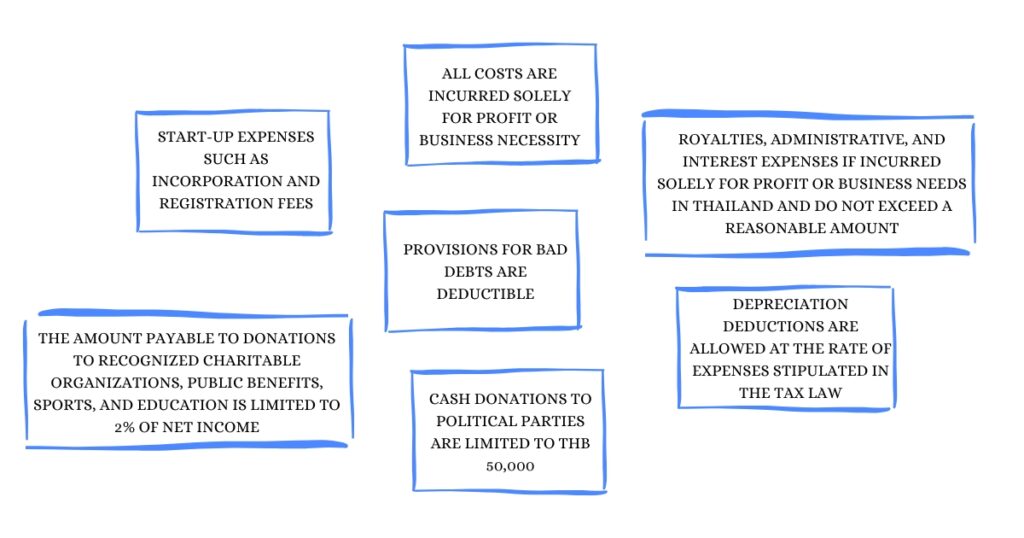

Are there any expenses that you can deduct from income tax ?

Here are the expenses that you can deduct from income tax in Thailand:

Get expert legal guidance.

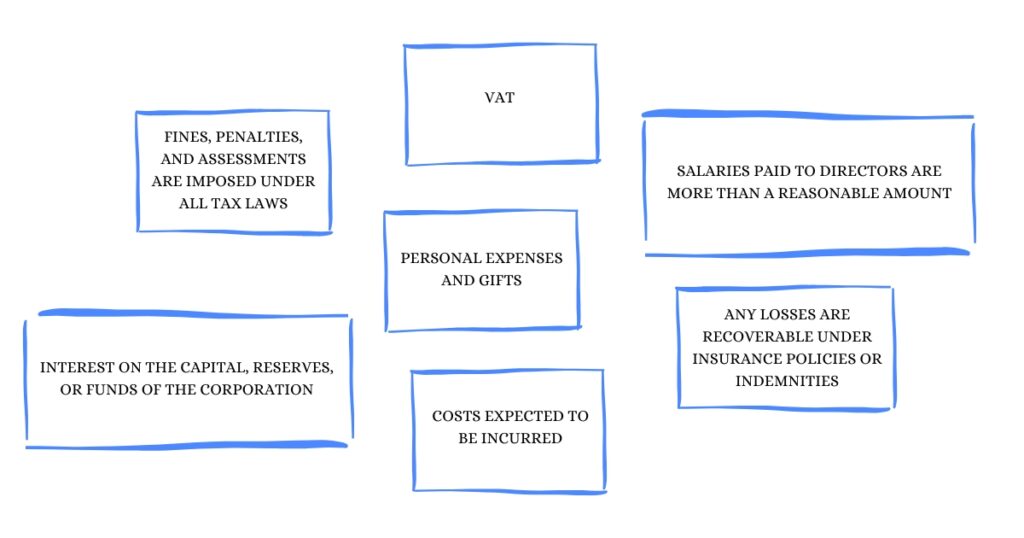

What expenses can you not deduct from income tax in Thailand ?

Unlike the previous section, you cannot deduct certain expenses from income depending on the income tax in Thailand:

When is a company subject to withholding tax ?

When a company conducts operations within Thailand’s borders, taxation law requires businesses to withhold payments for salaries, services, and rent. The company credits the sum retained as preliminary income tax due that year from the recipient. Variations occur, though, in withholding rates linked to income category, including:

- Dividends require the retention of 10% as tax.

- Property rent involves 5% held from amounts paid out.

- Rental expenditures are subject to 3% withholding.

- Transportation bills incur a 1% deduction.

- Parking fees are reduced by 3%.

- Interest is taxed at 1% tax bite.

- Royalties are reduced by 3%.

- Telephone charges get clipped 2%.

- Advertising outlays are taxed 2% up front.

- Proficient works require a 3% hold if remunerated to a Thai entity or foreign company with a permanent local office. Foreign contractors missing a continuous presence face a 5% shorn from compensation.

Taxes themselves require a 5% withholding.

How do companies and individuals register for and pay tax income in Thailand?

Firstly, enterprises conducting operations in Thailand must submit two tax returns annually: one at the conclusion of the fiscal year and another halfway through.

Both domestic and foreign firms active in the Kingdom must file form “PND 50”. They must do this within 150 days of the end of the financial year to report revenues and settle any tax responsibilities. Those with earnings sourced beyond Thailand must expedite payment using the “PND 54” withholding tax form. They must complete this within seven calendar days of separation and remittance of allocated portions.

Additionally, all corporate taxpayers must tender semi-annual advance remittances via form “PND 51”. Using half the projected annual tax liability, business must pay the estimate and prepayment within two months after the sixth month concludes. This provisional settlement may then be deducted from the yearly obligations.

Foreign entities receiving funds but lacking a Thai presence are liable to retain tax obligations. The disbursing party must submit declaration PND 54. The retained amount to the tax department within seven dates following the month of disbursement.

Conclusion

In summary, understanding tax income in Thailand remains essential for both individuals and companies operating in the Kingdom. The Thai tax system uses clear legal rules under the Thai Revenue Code. It includes progressive rates for personal income and structured obligations for corporate payers.

For individuals, tax residency status—typically defined by a stay of 180 days or more—determines whether worldwide income or only Thai-sourced income is subject to tax. Progressive rates range from exempt up to 35% for higher income brackets. This affects planning for both expatriates and Thai nationals alike.

For businesses, tax income in Thailand entails obligations such as withholding tax on salaries and service fees. It also demands filing returns annually and, in some cases, semi-annually. Compliance with these rules not only guarantees lawful operation under Thai law. It also reduces the risk of penalties and disputes with the Revenue Department.

Expert legal and accounting support helps navigate complex filing processes and optimise tax positions. When structured properly, understanding tax income in Thailand offers a strategic advantage for investors, expatriates, and businesses alike.

If you need further information, you may schedule an appointment with one of our lawyers.