Call us now:

Understanding Thai Tax Laws for Individuals & Businesses

Navigating the complexities of Thai tax laws can be challenging for both individuals and businesses. Thailand’s tax system includes a variety of regulations and obligations that necessitate careful attention to ensure compliance and maximize tax benefits. This guide provides a detailed overview of Thai tax laws, focusing on key elements that are essential for individuals and businesses to understand.

Table of Contents

What is personal income tax under Thai tax laws?

Income tax, or “personal income tax,” in Thai tax laws is levied on individuals and unincorporated companies. Residents, defined as those staying in Thailand for over 180 days annually, are taxed on global income. Non-residents are taxed only on Thai-sourced income, such as rent, salaries, or shareholding income.

- Annual tax declarations using the “PND 90” form must be filed by March 31, with late filings incurring a 1.5% monthly penalty. The form categorizes income into eight types, including wages, business income, and rentals.

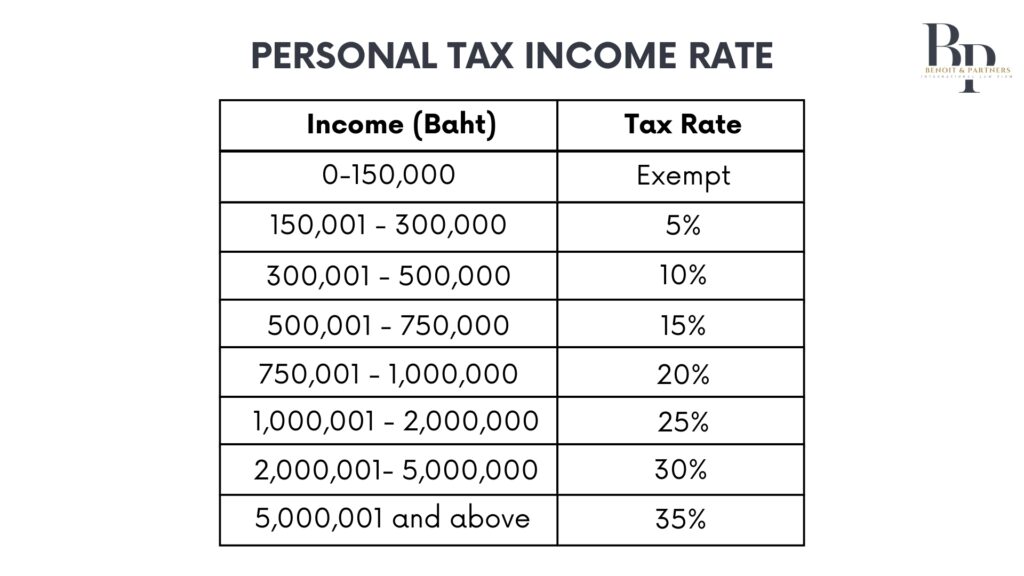

- Income Tax Rates: Income tax rates under Thai tax laws are progressive, starting at 5% and going up to 35% for income exceeding 5 million baht. Various deductions and allowances are available, including a personal allowance of 60,000 baht and additional deductions based on dependents and other factors.

What corporate tax under Thai tax laws ?

Corporate tax under Thai tax laws Businesses operating in Thailand must adhere to strict accounting and tax regulations as outlined in Thai tax laws, including the Civil and Commercial Code, the Tax Code, and the Accounting Law.

From inception, companies must register with the Revenue Department within 60 days to obtain a tax identification number. They aslo must maintain proper accounts, prepare annual financial statements, and submit them to the Department of Business Development (DBD) within one month of approval.

- Taxable income: Profits after deducting expenses such as salaries, rent, and utilities.

- Filing requirements: Annual tax return using the “PND 50” form within 150 days of the end of the accounting period.

- Semi-annual tax return: “PND 51” form by August 31 for mid-year profits.

- Reduced Rates for SMEs (Small and Medium Enterprises) :

- 15% for profits up to 3 million baht

- 20% for profits above 3 million baht

What is withholding tax under Thai tax laws ?

Withholding tax is deducted by companies from payments to service providers, employees, or shareholders, resulting in a lower payout than agreed. The payer remits the tax on behalf of the recipient, who can then claim a tax credit during their annual declaration.

- Deduction rates vary by income type: 10% for dividends, 5% for rental income, 3% for professional fees, and more. Companies must report these deductions to the Revenue Department within the first seven days of the following month.

- Declaration forms: Monthly withholding tax returns using the appropriate forms:

- “PND 1”: Salaries to employees

- “PND 2”: Interest and dividends

- “PND 3”: Payments to individuals

- “PND 53”: Payments to legal entities

- Withholding tax rates for payments to foreign companies:

- 10% for dividends and profits

- 15% for interest, royalties, capital gains, rents, and professional fees

- Rates can be reduced or exempted under bilateral tax treaties to avoid double taxation.

What is VAT under Thai tax laws?

Value Added Tax (VAT) under Thai tax laws is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to sale. The law mandates businesses to collect VAT on behalf of the government and remit it accordingly. Businesses with annual sales exceeding 1.8 million baht must register for VAT and file monthly returns. The standard VAT rate in Thailand is 7%.

- VAT Compliance: Businesses must comply with Thai tax laws by filing VAT returns by the 15th of the following month using the form “PP 30”. VAT on services procured from foreign providers must be reported using the form “PP 36” within seven days of the following month.

- VAT Invoicing: When registered for VAT, ensure VAT-registered sellers issue a tax invoice upon delivery of goods. Non-VAT sellers cannot issue tax invoices. For services, issue tax invoices only after payment. A tax invoice must include:

- The words “tax invoice” prominently

- Issuer’s name, address, and taxpayer ID

- Purchaser’s name and address

- Serial number of the invoice

- Description, type, class, quantity, and value of goods or services

- Clearly separated VAT amount and the date of issue

What is specific business tax?

Specific Business Tax (SBT) under Thai tax laws applies to certain businesses, including banking, finance, securities, insurance, pawn shops, and real estate sales. These businesses pay SBT instead of VAT, with rates ranging from 2.5% to 3.0% on monthly gross receipts.

- SBT-eligible businesses must pay VAT on their purchases but cannot claim VAT credits.

- SBT must be declared monthly, following the same procedure as VAT.

- An additional 10% municipal tax is added to the SBT payable.

What is social security contributions?

Social security contributions are mandatory payments made by employers and employees into the social security system. The law ensures that employees receive benefits such as healthcare, maternity leave, and pensions. Thus, when a company hires an employee, it must register with the Social Security Fund to obtain a social security identification number and register each new employee as they are hired.

1. Both employers and employees contribute to social security. Employers deduct the employee’s contribution from their salary and submit the payments monthly by the 15th using form “SSO 1-10”. Employees can deduct their social security contributions from their taxable income when filing their income tax return.

2. The contribution rate is 5% of the employee’s monthly salary, capped at 750 THB. Social security coverage applies to individuals aged 15 to 60 and ends upon death or termination of employment.

3. Social security provides protection for accidents, non-occupational illnesses, disability, maternity, death, children, old age, and unemployment.

Understanding and complying with Thai tax laws is crucial for both individuals and businesses. Given the complexity of the tax system, seeking professional advice can be highly beneficial. For official guidelines and tax forms, consult the Thai Revenue Department’s website.

For further information or personalized consultation on Thai tax laws, please contact Benoit & Partners. Our team of experts is here to assist you with all your tax-related needs.