Call us now:

Vat Registration in Thailand.

Any business in Thailand should be aware of the country’s tax regulations. Specifically, Value Added Tax is an important part of the Thai taxation system necessary for the country’s life and development. Thus, VAT registration in Thailand is an important process that should be studied in detail by any worker in Thailand and anyone planning to start a business in the Land of Smiles.

Table of Contents

What is VAT ?

Value Added Tax in Thailand, as an example, is an indirect tax that levied on goods and services at each production and distribution level. It is the consumer that bears the burden, while the collected value added tax becomes revenues for the Thai government. This type of business tax is administered by the office of the Revenue Department , as it is in charge of tax implementation and collection.

The standard value-added tax rate in Thailand is 7%. However, there are certain special offset rates, such as 0% and 3%, applicable to some goods and services. A registered business in Thailand is required to collect the 7% value-added tax rate on each sale or service rendered. The business should then submit the collected VAT to the Revenues office. Additionally, the business has a privilege of making some input VAT credit claims to offset the vat sales that they have paid on their company purchases or running expenses when submitting the accounting supervised by the Revenue Department.

A business is eligible to VAT registration when it is profitable. It is about 5 000 000 Baht. However, some businesses may also not be registered, such as one which operates at a smaller scale or certain sectors that do not need to be registered as set out by the Revenue Department. Compliance required successful registration for any business dealing in Thailand to prevent the business from being penalized and dismissing it with the country’s tax.

What are the regulations ?

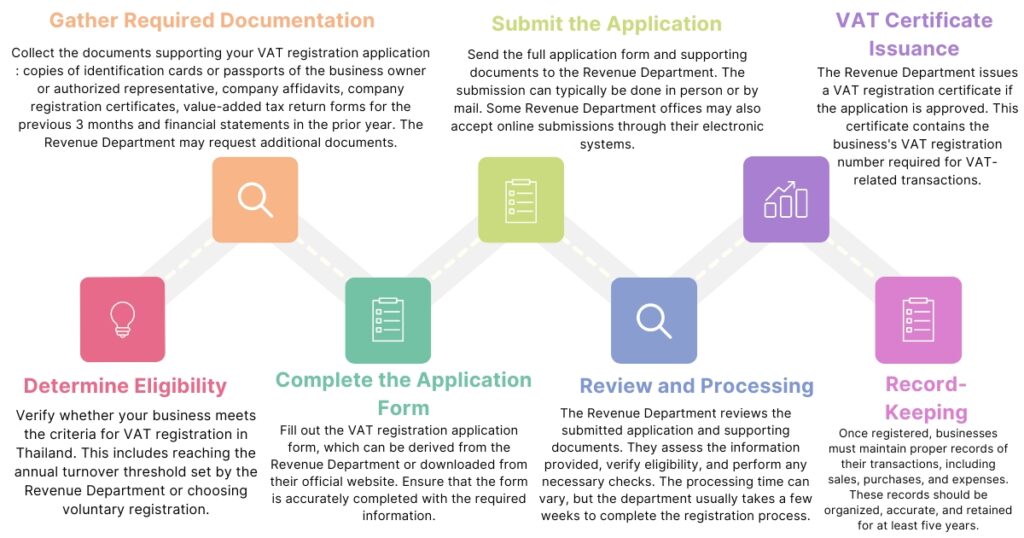

The Revenue Department of Thailand regulates the regulation of VAT registration in Thailand and therefore, they follow specific conditions and procedure. Below are the specific rule for VAT registration in Thailand :

- Threshold Businesses : That make or exceed the threshold set annually by the Revenue Department shall register for VAT . However, it is crucial to notice that the threshold may change and always check for the yearly threshold.

- Voluntary Registration : Registration is allowed even when a business owner turnover does not reach the set threshold. The owner may decide to register his company to be able to claim the input VAT credits on purchases or transaction levels required.

- Application Process : Application when registration for VAT must apply with the Revenue Department. The applicant should fill in the details on the form accurately and accurately giving all the requirement for the registration.

- Required Documents : Document required generally required factors when applying for the VAT registration document includes :

- A copy of the business owner or the authorized representative identification photocopy of identification cards or passport.

- A copy company registration certificate which may empowered the business.

- Document for a copy of the value-added tax return form for the last 3 months. If the businesses are already existing.

- Registration Timeline : Timeline the process of the registration when registered with the Revenue Department is a few weeks, which may take a month or so.

- VAT Certificate : The revenue Department shall issue a VAT registration Certificate at the same time of commencement. Records VAT registered businesses shall keep records of their sales and purchases of goods and services for the five years and shall produce all detailing during the Department’s require.

What is the procedure for VAT registration in Thailand ?

Free

consultation

What are the VAT exemptions ?

There are specific goods and services that can qualify for VAT exemptions in Thailand. However, VAT exemptions imply that businesses are relieved of paying VAT on the respective transactions. The following are six VAT exemptions in Thailand:

- Export of Goods and Services : In general, VAT does not apply to goods and services exported from Thailand. Exporters can be offered VAT exemptions if they complied with the applicable regulations and procedures in export documentation and customs clearance.

- International Transportation : VAT does not apply to international transportation, including air, ocean freight, and other related services, operating in Thailand.

- Certain Financial Services : lending money, paying interest on loans, insurance premiums , and other services including securities, and derivatives can obtain VAT exemptions.

- Sale or Transfer of Business as a Going Concern : Relevant transfers of assets and liabilities in cases where the business is sold under concern may receive VAT exemption. VAT exemption is granted when the buyer can continue the business without any changes.

- Residential Rent : VAT’s do not apply to rental incomes from properties used as residents for dwelling purposes. However, it applies to rental incomes from commercial and other specific properties.

- Specific Healthcare and Education Services : VAT does not apply to medical and healthcare services and educational services from profit institutions. However, the businesses operating in the aforementioned areas can apply for voluntary registration. Voluntary registration allows them to recover inputs tax to the business with exempted transactions.

The rules and conditions for VAT exemption may be changed by the Thailand Revenue Department. It is suggested to seek tax lawyer or refer to Thailand Revenue Department’s website to ensure the most updated rules regarding VAT exemptions and VAT Registration in Thailand.