Call us now:

What are the BOI advantages for foreign investors in 2024?

Thailand has steadily grown more appealing to foreign investors in recent years due to the alluring advantages provided through their Board of Investment, known commonly as the BOI. Tax holidays, duty-free imports on machinery and raw materials, and simplified registration are some of the more prominent pulls for businesses. Meanwhile the strategic location, modern infrastructure, and high quality of daily life keep drawing more expats each year.

As one example demonstrating the effectiveness of these advantages, over 1.600 new enterprises were facilitated by the BOI in 2023 alone. Such factors coupled with a welcoming business environment and emerging sectors poised for innovation have cemented Thailand as a premier destination in Southeast Asia.

The legal framework underpinning these BOI advantages for foreign investors is primarily the Investment Promotion Act of 1977, which was most recently updated in 2023 to reflect the nation’s evolving economic priorities. As defined within this Act, the BOI’s mission is to stimulate growth by attracting investments that align with national developmental goals. Their revised investment vision centers around three core pillars: driving an economy powered by technology, creativity, and innovation; building an economy that is resilient, adaptable, and capable of sustaining high growth over the long term; and ensuring an economy that values environmental and social sustainability, creates opportunities for all, and reduces inequality.

What is the BOI and how does it facilitate foreign investment?

The Board of Investment serves an important role in Thailand as it works to attract foreign investors while adhering to regulations regarding foreign ownership. Through advantages like tax breaks, import duty reductions, and advisory services, the BOI encourages investment in strategic sectors to stimulate economic growth. By providing advantages that allow 100% foreign ownership unlike traditional methods limited to 49% (FBA), it draws international funds and expertise to benefit Thailand’s long-term competitiveness on the global stage.

What are the several activities promoted by the BOI for foreign investors in 2024?

While restrictions apply in many fields, the BOI’s guidelines for 2024 detail an extensive catalog of promoted activities. Ranging from agricultural technology to medical devices, their list includes sections for machinery, transportation, and electronics among others. Subsidies differ depending on the project’s economic and development impacts, but tax holidays, work permits, and duty-free imports frequently feature. By tailoring support to priority industries, the BOI drives foreign participation in line with national priorities.

- Metal and Material Industry

- Metal, material, and manufacturing sectors

- Chemical and Petrochemical Industry

- The chemical production and petroleum refining domains

- Public Utilities

- Infrastructure services and development

- Digital Industry

- Technology and innovation ventures

- Creative Industry

- Arts, design, and entertainment ventures

- High-Value Services. Professional services focusing on specialized skillsets.

What are the various BOI advantages in 2024?

The BOI provides a range of benefits and advantages to encourage international investment across strategic industries.

Advantages from the BOI vary considerably depending on the nature of the venture but generally include substantial fiscal and non-fiscal perks. For example, BOI support may exempt corporate income tax for up to 13 years or halve income tax for up to 5 years based on the project classification. Additionally, BOI advantages for foreign investors in 2024 could waive import tariffs on machinery, equipment, and raw materials used for manufacturing or research and progress.

On the non-monetary side, BOI advantages for foreign investors in 2024 may also issue permits crucial to overseas operations. This may include allowing foreign nationals to enter Thailand to explore possibilities, bringing in skilled employees and experts, remitting funds abroad in foreign currency, and even owning land for qualifying ventures. However, the specific BOI advantages for foreign investors in 2024 will rely on how well the project aligns with the BOI’s strategic sectors, with high-priority projects receiving the most generous support.

What are the criteria for foreign investors to qualify for BOI advantages in 2024?

To be eligible for BOI advantages in 2024, ventures must meet certain standards and abide by terms set by the BOI. These requirements are intended to ensure promoted projects meaningfully contribute to Thailand’s economic growth.

- Alignment with national economic goals:

Projects must align with Thailand’s long-term national economic goals, particularly promoting technological advancement, elevating industrial capabilities, and ensuring sustainable growth. The BOI prioritizes ambitious undertakings with demonstrated lasting economic impacts.

- Use of cutting-edge production processes:

Qualifying endeavors must leverage state-of-the-art, efficient manufacturing methods that reinforce Thailand’s competitive edge in global industries. This involves adopting emerging technologies, implementing environmentally sound practices with careful consideration, and satisfying international quality standards.

- Capital investment thresholds:

A minimum capital outlay of 1 million baht is necessary for foreign investors, excluding land and working capital costs, to be considered for BOI benefits in 2024. Proposals exceeding 2 million baht warrants comprehensive paperwork during application review.

- Environmental safeguards:

All projects must abide by Thailand’s environmental protections, applying measures to preserve environmental integrity while mitigating negative consequences. The BOI places emphasis on location selection and environmental effects analysis, especially for sensitive locales.

- Technological and R&D Commitments:

Higher incentive tiers like A1 and A1+ (highest division group amongst the projects’ categories established by the BOI) necessitate meaningful contributions to research and development in Thailand. This involves establishing R&D hubs, collaborating with local research institutions, and transferring technologies to domestic industries.

What are the additional BOI advantages for foreign investors in 2024?

The BOI also provides extra advantages for foreign investors delivering outstanding benefits to Thailand or priority sectors. These extra advantages in 2024 center on specific domains:

Industrial Area Development: Foreign enterprises in industrial estates or designated zones receive an additional year of corporate income tax exemption, apart from activities already requiring location in these zones.

Decentralization: Enterprises situated in “Development Promotion Zones” receive an additional three years of corporate tax exemption and further reduction in levies. Group A1 and A2 businesses, after their initial eight-year waiver, obtain a 50% deduction on earnings for five ensuing years. A 25% subtraction on infrastructure expenditures is also accessible, dispersed over a decade.

These benefits apply to qualified activities unless expressly excluded.

What are the BOI advantages in strategic zones in 2024?

The BOI has designated certain promotion areas to drive financial growth in key industries. Included in these are the Eastern Economic Corridor (EEC) and exceptional Economic Zones (SEZs) founded under the Office of the Prime Minister’s rules. Additionally, the BOI targets the southern border provinces and Model City Project territories to encourage progress and harmony. Extra advantages are also extended to enterprises in 20 provinces with low average earnings, advancing decentralization and inclusive advancement. These zones are further backed by Science and Technology Parks, like Innovation Districts, fostering progressive examination and evolution. The following is the catalogue of those zones:

- Kalasin

- Chaiyaphum

- NakhonPhanom

- Nan

- BuengKan

- BuriRam

- Phatthalung

- Phrae

- MahaSarakham

- Mukdahan

- MaeHongSon

- Yasothon

- RoiEt

- SiSaKet

- SakhonNakhon

- SaKaew

- Surin

- NongBuaLamphu

- UbonRatchatani

- Amnatcharoen

How can foreign investors apply for BOI advantages in 2024?

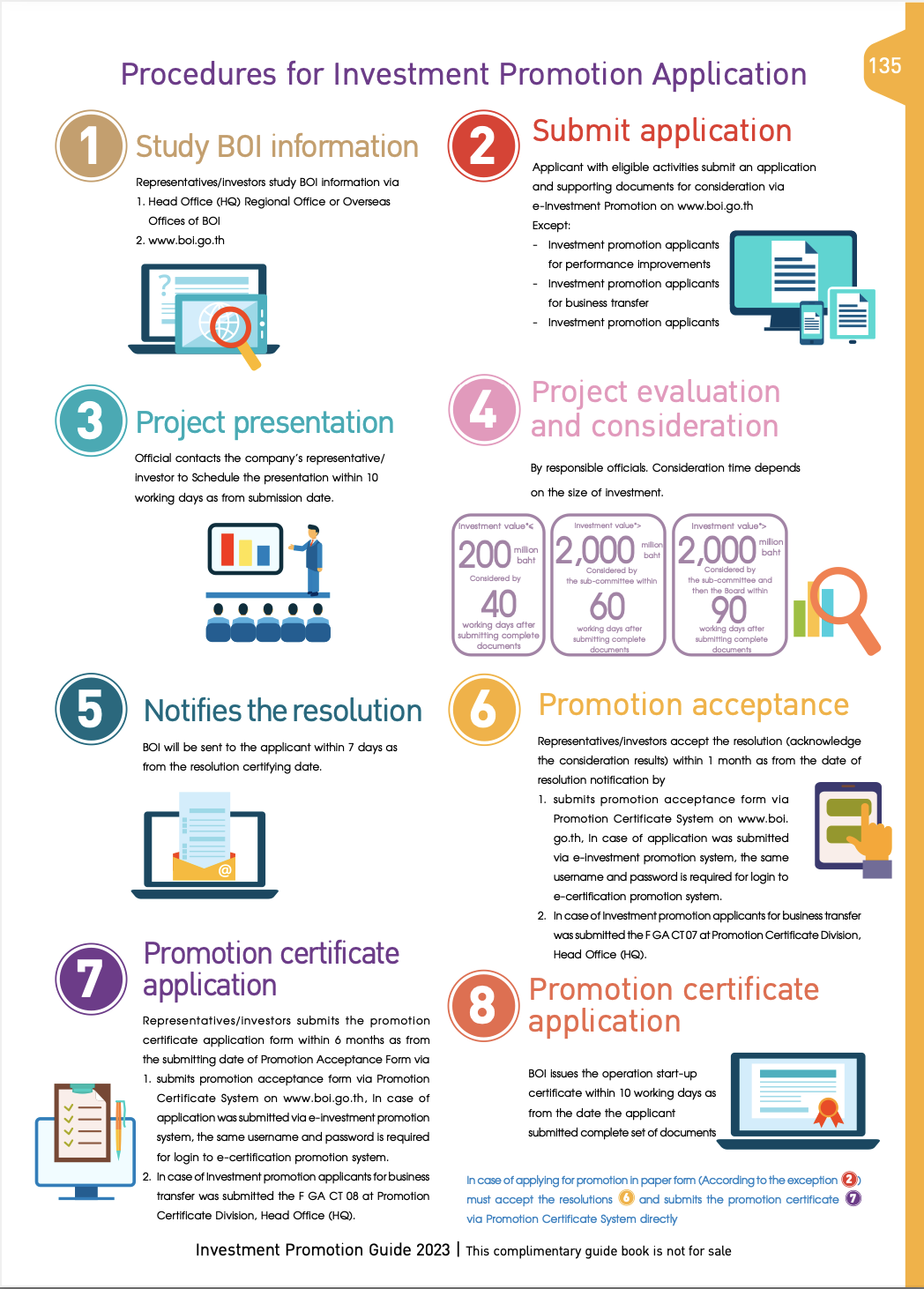

The BOI application method for foreign investors in 2024 is a structured, 8-step process that demands judicious planning and precise documentation. Here is a concise outline that might assist you:

1. Study BOI Information : Foreign investors begin by examining BOI advantages through the BOI’s website or local workplaces to grasp eligibility and necessary documentation.

2. Submit Application : Eligible foreign investors must submit their applications through BOI’s online portal, unless special considerations apply. Supporting documents are also required.

3. Presentation & Alignment : Within 10 business days, BOI officials schedule a meeting where foreign investors thoroughly explain how their ambitious project directly supports Thailand’s strategic economic aims.

4. Rigorous Evaluation : The complex proposal undergoes intense scrutiny based on investment size, with timelines extending from 40 to 90 working days for larger endeavors. No stone is left unturned in the vetting.

5. Notification of Decision : Foreign investors receive notification of the outcome within seven days of the board reaching a resolution. Results vary significantly in nature.

6.Acceptance Required : Investors have just one month to formally accept the granted terms, submitting confirmation through BOI’s digital platform. Missing this deadline spells trouble.

7.Formalize Approval : Following acceptance, the authorization certification must be requested within six months via the same system. Procrastination is not an option.

8. Issue Certification : Provided all papers are in order, the BOI releases the final permit within 10 business days of receipt, unlocking the potential to commence operations at long last.

The whole procedure, from first documents to permit distribution, can encompass various months depending on intricacy and thoroughness of substantiation submitted. Accurate documentation, like business plans, projections, and licenses, is pivotal for foreign investors seeking BOI incentives in 2024 to secure their success.

Here follows a diagram summarizing the previous explanations on the procedure for investment promotion application:

source : https://www.boi.go.th/upload/content/BOI_A_Guide_EN.pdf

Conclusion

BOI advantages for foreign investors in 2024 offer a strategic edge for those aiming to establish or expand their operations in Thailand. By carefully navigating the various incentive categories, investors can maximize the benefits tailored to their specific needs. These advantages provide not only significant financial benefits but also ease business operations in a country where foreign ownership regulations can be restrictive. Furthermore, as Thailand solidifies its position as a hub for innovation and investment, the BOI remains an indispensable partner for foreign investors seeking to achieve their ambitious business objectives in Southeast Asia.

While the BOI offers the most comprehensive package for foreign investment, alternative options do exist for establishing a business presence in Thailand, such as forming joint ventures with domestic partners, setting up representative offices, or applying for a Foreign Business License.

However, these options often come with more constraints and fewer rewards, thereby making the BOI advantages for foreign investors in 2024 the most appealing and advantageous pathway overall for corporations aiming to thrive and grow in the high-potential Thai market.